SEVIER COUNTY, Tenn. — According to Sevier County leaders, there are around 13,000 overnight rental properties. This can include properties rented by Airbnb users, or users of similar apps.

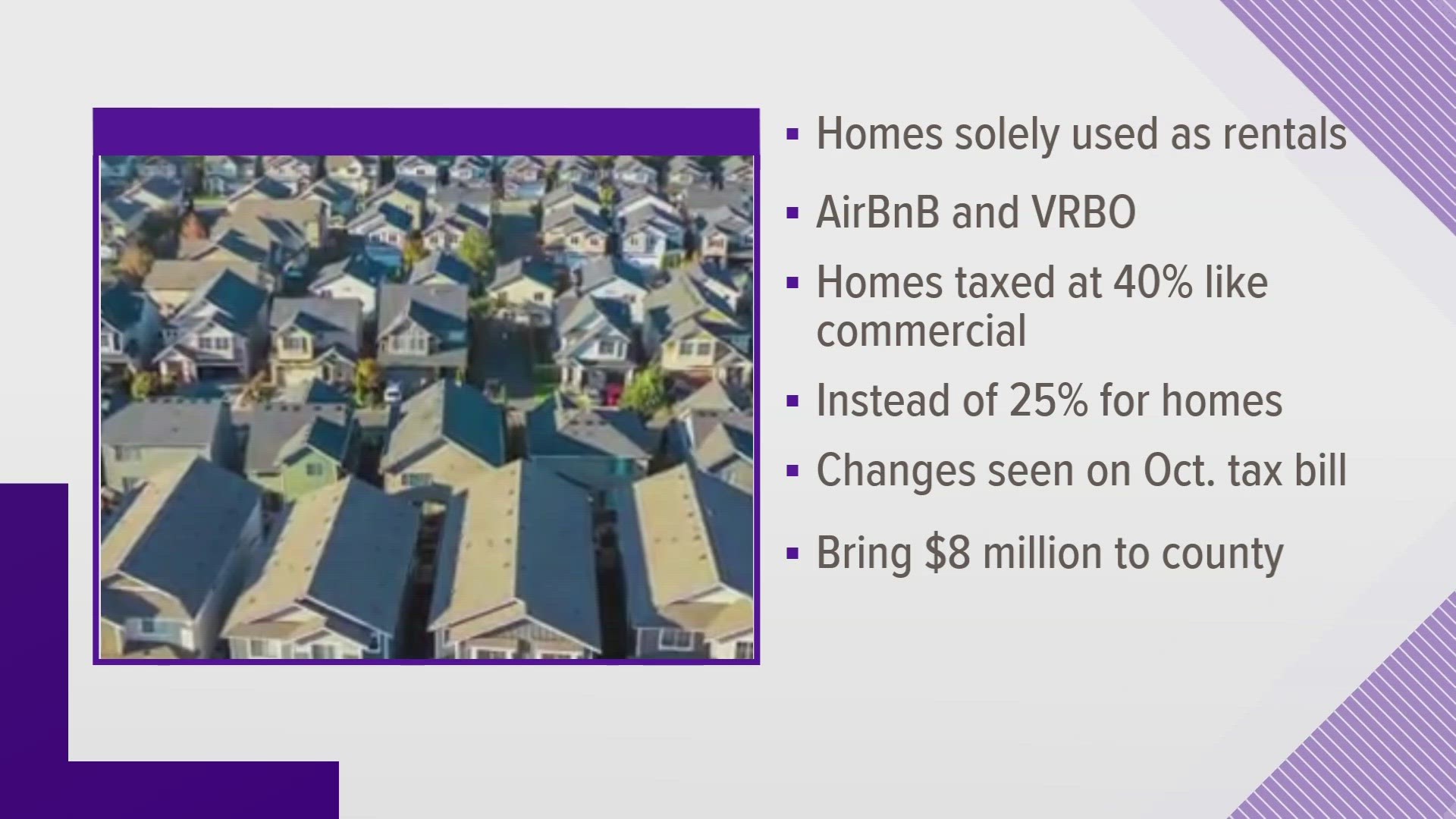

On April 17, the Sevier County Commission voted to affirm guidance from the Tennessee Comptroller's Office and start taxing them as commercial properties. According to a release from the county's property assessor, the office issued a bulletin in 2021 which specifically said that "parcels that are used as short-term rentals are to be classified as commercial unless specific exemptions are met."

Around 2,500 overnight rental properties were already being taxed as commercial properties in the state, according to the county property assessor. By affirming the state's guidance, an additional 10,500 would be taxed at a 40% rate. It would only impact rentals with a business license and which are not principal residences.

When they were classified as residential properties, they were taxed at a 25% rate.

That means the owner of a cabin with an appraised value of $500,000 would start paying around $2,960 in county property taxes. Before affirming the comptroller's guidance, the owner would have paid around $1,850 in taxes.

"Sevier County maintains one of the lowest property tax rates in the State of Tennessee at $1.48 per $100 of assessed value. Even though this update in state law certainly increases the amount of property tax a short-term rental will pay, on average short-term rentals across Sevier County are undervalued by over 53% since our last reappraisal in 2021," said Thomas King, the county property assessor.

They said the changes would take effect for the current year, and the property assessor's office would send out assessment change notices with a letter explaining the state law in May. The changes will show up on tax bills scheduled to go out in October 2023, payable through February 2024.

They said the new tax rate would create around $8 million in revenue for the county. The resolution to change the tax rate passed with a 21-4 vote.