KNOXVILLE, Tenn. — The City of Knoxville hosted its fourth community open house on Thursday, bringing people together in West Knoxville to discuss the city's goals and projects. Much of the meeting focused on affordable housing.

Housing affordability in the city is at its lowest point since the 1980s, according to a recent report from the Knoxville Area Association of Realtors. In West Knoxville, the average price for a one-bedroom home is around $160,000 — and $11,000 jump compared to last year.

"West Knoxville has great employment opportunities and schools," said _____. "Nothing brings down a neighborhood more than a property that is being attended that may be open, that may be hazardous."

To help increase the supply of homes on the real estate market, Knoxville leaders created the Homemakers Program. Through the program, the city offers vacant lots and lots with substandard homes to possible buyers.

These buyers are required in nearly all cases to either build a new dwelling on the lot or rehabilitate the existing structure. City leaders said they want to make every neighborhood desirable to live in, no matter what income a person makes.

They said they are spending around $2 million on their Affordable Rental Development Program, which is meant to create more affordable homes for low-income renters.

The report found that on average, rental prices in Knoxville rose by around $450 on average compared to before the COVID-19 pandemic. It also said that the city's occupancy rate rose in 2022 to 98.3%, compared to 98.2% in 2021.

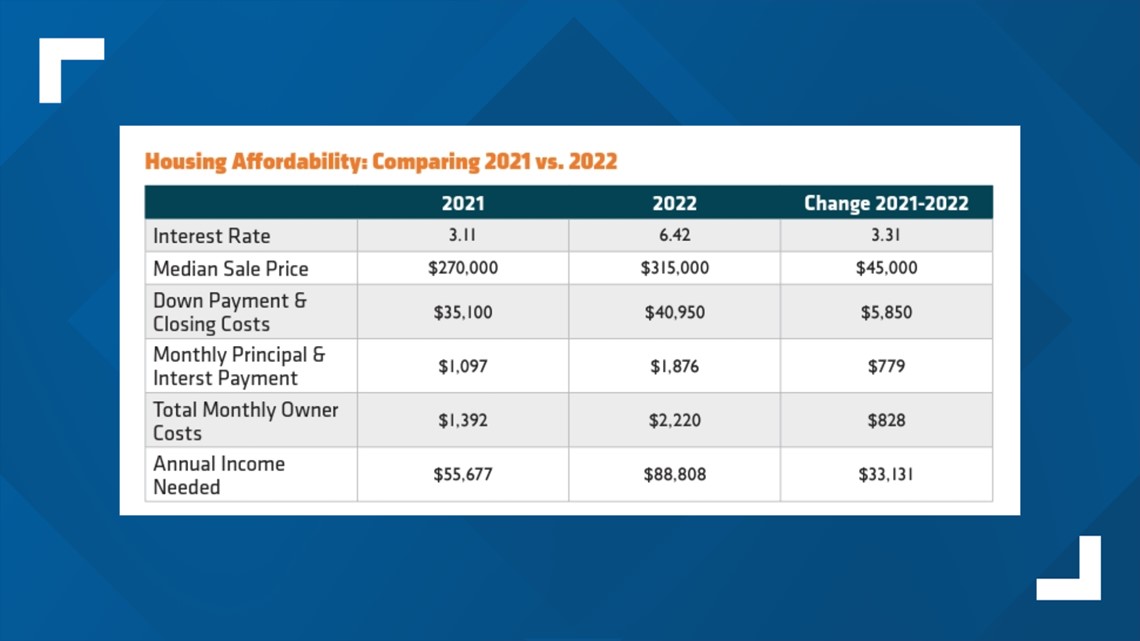

The KAAR report said in 2021, a household would need to make around $55,677 per year to afford a median-price home, which was then around $270,000. The following year, they said a household would need to make around $88,808 to afford the same median-priced home.

It also said in 2021, the city saw around 24,000 homes sold. In 2022, that number dropped by 9% to 21,000 homes.

It said that part of the reason for fewer listings in the area is because of rising mortgage interest rates. He said that around 80% of all mortgages in Tennessee are below 5%, which can dissuade people from selling their homes and having to get a new mortgage with a higher interest rate, creating the "lock-in effect."