The largest health insurance company in Tennessee will stop covering OxyContin prescriptions next year as part of sweeping policy changes intended to combat opioid addiction and make pain pills less valuable on the black market.

The shift is a major blow to one of the drugs that ignited the nationwide opioid epidemic. In place of OxyContin, BlueCross BlueShield of Tennessee will instead encourage doctors to prescribe two other painkillers that are engineered to be more difficult to abuse.

BlueCross will publicly disclose the decision to abandon OxyContin for the first time during meetings with insurance brokers on Thursday. OxyContin will no longer be covered on Jan. 1.

“We are not telling our physicians you cannot prescribe this. We are not telling our members you cannot receive this,” said Natalie Tate, BlueCross vice president of pharmacy. “We are just drawing a line that we will not continue to pay for this and we have alternatives we have now put into place.”

Those alternatives are Xtampza and Morphabond, two opioid pain relievers that will be added to BlueCross coverage as preferred medication next year. These drugs, often described as “abuse-deterrent” medication, are generally more expensive than OxyContin, but BlueCross will absorb the additional cost, Tate said. Customers will still pay the same copay for pain relievers despite the switch.

Cancer and hospice patients will be exempt from the coverage changes but their prescriptions will still require approval from BlueCross.

At the center of the opioid crisis

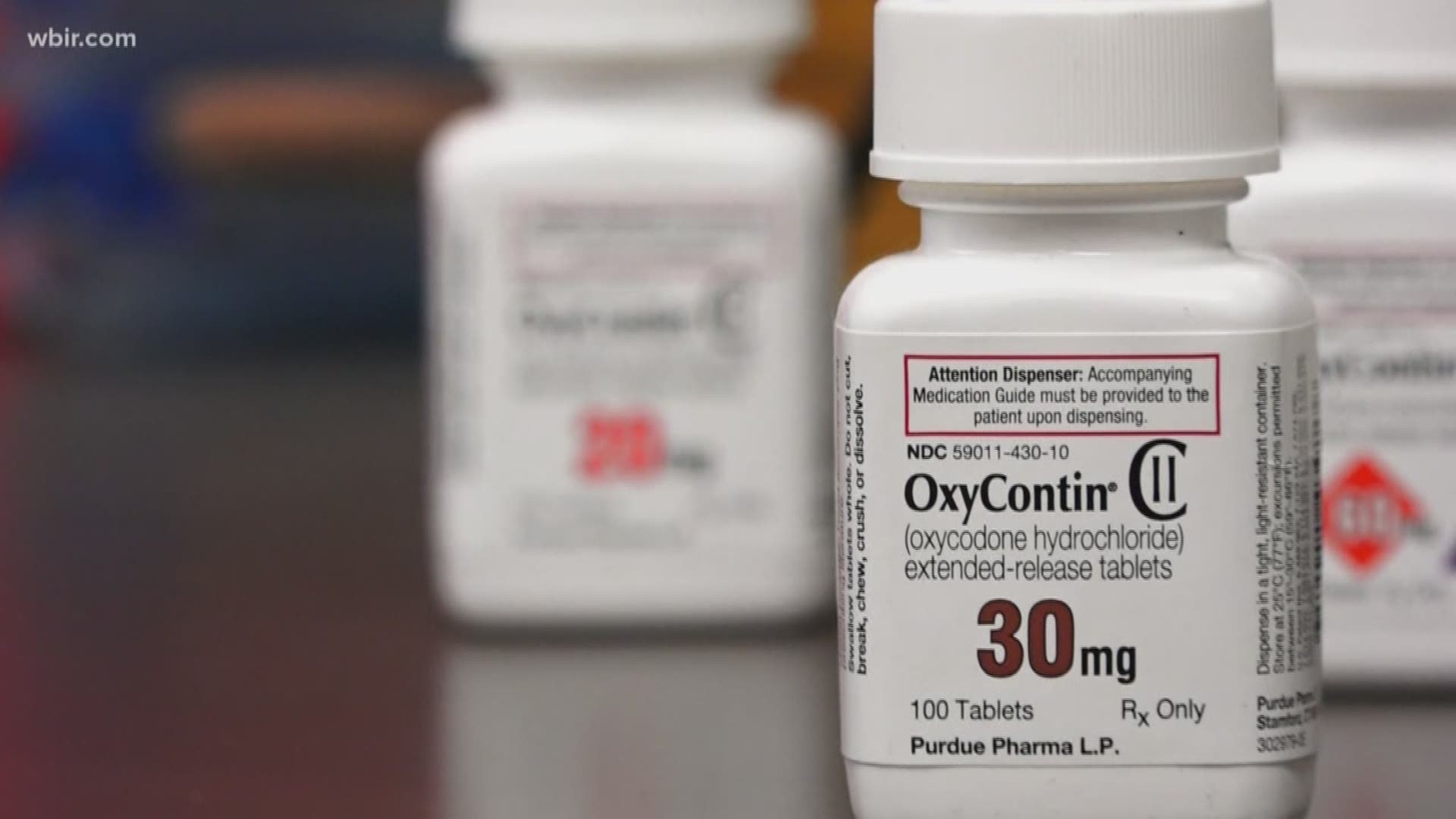

OxyContin, a brand name of the opioid oxycodone, is a highly-addictive pain reliever at the core of the opioid overdose epidemic, which last year killed 1,268 people in Tennessee and 49,000 nationwide. The corporation that makes the OxyContin, Purdue Pharma, has been accused of pressuring doctors to over-prescribe the drug in lawsuits filed by states and counties throughout the country, including Tennessee and Davidson County.

BlueCross officials said these lawsuits, in addition to a “groundswell” of health concerns about opioids, has decreased demand for OxyContin and offered an opportunity to shift coverage away from the once-popular painkiller. This shrinking demand dovetailed with improving confidence in abuse-deterrent drugs, ultimately leading to what Tate described as a “progressive decision” to swap medications.

OxyContin is generally abused by grinding it into powder, destroying a delayed-release quality of the pill so that addicts can unlock its full potency in an instant. Xtampza and Morphabond, however, are designed to be less potent when crushed, and therefore harder to abuse or resell on the street.

“We are not seeing as much use of (OxyContin) as we have historically, and so for us, we just felt it was the right thing to do to move to more abuse-deterrent formulations,” Tate said. “The way these drugs are structured, you can’t get the entire dose at once, even if you do break it down.”

BlueCross, which covers about 70 percent of insured Tennesseans, is not the first large insurer to make the switch but it remains one of only a few. Cigna, a BlueCross competitor, stopped covering OxyContin this year, as did Florida Blue, the largest insurer in Florida. Both companies replaced OxyContin with Xtampza, saying they were trying to minimize their role in the opioid epidemic.

Weaker opioids, increased scrutiny

In addition to dropping OxyContin, BlueCross BlueShield of Tennessee will implement the following opioid prescription changes in the new year:

- For customers who are just beginning a new opioid prescription, BlueCross will only cover the first seven days of their prescription on an initial pharmacy visit. Patients can return to the pharmacy a week later so BlueCross will cover the rest or pay out-of-pocket to fill the entire prescription upfront.

- For most customers who are prescribed short-acting opioids for an extended period, BlueCross will automatically freeze coverage after 30 days, then require the patient undergo an authorization process to ensure the medicine is strictly necessary.

- Finally, the company will lower the threshold for opioid prescription strength that is willing to cover by about 40 percent. Previously, BlueCross would cover opioid prescriptions with a daily dose equivalent of 200 milligrams of morphine, but that daily limit will be lowered to a 120.

Tate said most customers should not notice a significant decrease in the strength of their medication because the effectiveness of opioid painkillers tapers after the new limit. This limit of 120 morphine milligram equivalency (MME) is recommended by the Centers of Disease Control and Prevention.

“For the vast majority of people, you see no difference in pain relief if you are getting 100 MME or 500 MME,” Tate said. “But what you do see is an increased risk of overdose and death.”

BlueCross officials said they believe the most impacting change for patients will be the new requirement for authorization on opioid prescriptions that last more than 30 days. The company will automatically halt coverage of the prescription, then require the prescribing doctor to answer questions about the necessity of the medication before resuming coverage. All authorization requests are reviewed within three days, BlueCross said.

BlueCross Chief Medical Officer Allison Willis said the policy will ensure opioid prescriptions are “appropriate,” but the company fully expects some blowback from customers who feel inconvenienced or insulted by the scrutiny.

“Really, what this is meant to do is ask a question – Is this necessary? – and I think that hasn’t been asked for a lot of people,” Willis said. “I do think some people will respond with ‘how dare you even ask?’”

Medicare customers exempt; Obamacare customers aren't

All of these coverage changes come with some exceptions, however.

The new opioid policies and drug swap will impact nearly all fully insurance patients, which are most customers who are insured with BlueCross through their employer. The changes will also affect Tennesseans who are insured by BlueCross through the Affordable Care Act, also known as Obamacare.

However, some of the company’s largest customers – employee groups with what is called “self-funded” insurance – can potentially opt out of the coverage changes, including the restriction on OxyContin. Additionally, the new prescription-strength limit will not apply to BlueCross Medicare customers because that threshold is decided by the federal government, not the company.

The new policy changes will also not impact anyone who is insured by an out-of-state chapter of BlueCross, like Blue Cross and Blue Shield of Texas, even if they live and work in Tennessee. Likewise, customers of BlueCross BlueShield of Tennessee will still be impacted by the coverage changes even if they live or work in another state.

Brett Kelman is the health care reporter for The Tennessean. He can be reached at 615-259-8287 or at brett.kelman@tennessean.com. Follow him on Twitter at @brettkelman.