BLOUNT COUNTY, Tenn. — Blount County Commissioners gathered Thursday to vote on a proposal that would set the property tax rate in the county at $1.59 per $100 of assessed value following a reappraisal of homes across the area.

The proposal came after months of controversy. State law requires the counties and cities to reexamine property tax rates after a reappraisal to make sure higher taxable values do not automatically result in a tax increase.

This is known as the "certified tax rate law" and requires local governments to conduct public hearings before adopting a property tax rate that generates more taxes overall in a reappraisal year than were billed the year before, at the previous year's lower values.

A separate state law allows counties to implement a tax rate exceeding the certified tax rate, as long as they advertise their intention ahead of time.

Before the reappraisal, the county had a tax rate of around $2.47 per $100 of assessed value. After the reappraisal, the county had to change that rate in order to follow state law and maintain the same level of revenue from property taxes, since the increased property values would have led to increased revenues if the rate stayed the same.

A separate proposal would have set the new rate at $1.69 per $100 of assessed value, which would have increased the amount of money that the county makes off property taxes. A budget committee recommended against that proposal ahead of Thursday's meeting.

By setting the rate at $1.59 per $100 of assessed value, the county avoids making additional money off property taxes.

A breakdown of where property taxes would go in the county's budget is available below.

- General County - $0.69

- Debt Service - $0.22

- Gen. Admin. Capital Projects - $0.03

- General Purpose Schools - $0.55

- Education Capital Projects - $0.10

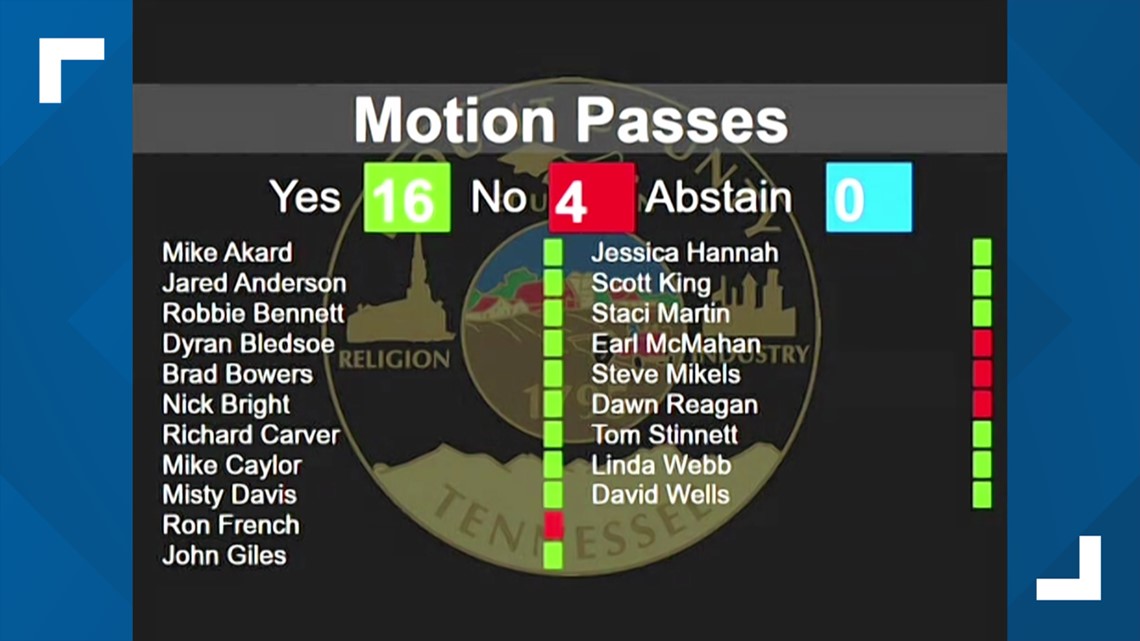

The proposal passed by a 16-4 vote Thursday evening.