KNOXVILLE, Tenn. — Millions of Americans are receiving cash from the IRS to help relieve some financial stress of the COVID-19 pandemic. But how far will that money go in East Tennessee? Let's crunch some numbers.

According to the Bureau of Labor and Statistics, in May 2018 workers in the Knoxville Metropolitan Statistical Area had an average hourly wage of $21.70. That’s about 13% below the nationwide average of $24.98. The Knoxville Metropolitan Statistical Area includes Anderson, Blount, Campbell, Grainger, Knox, Loudon, Morgan, Roane, and Union Counties.

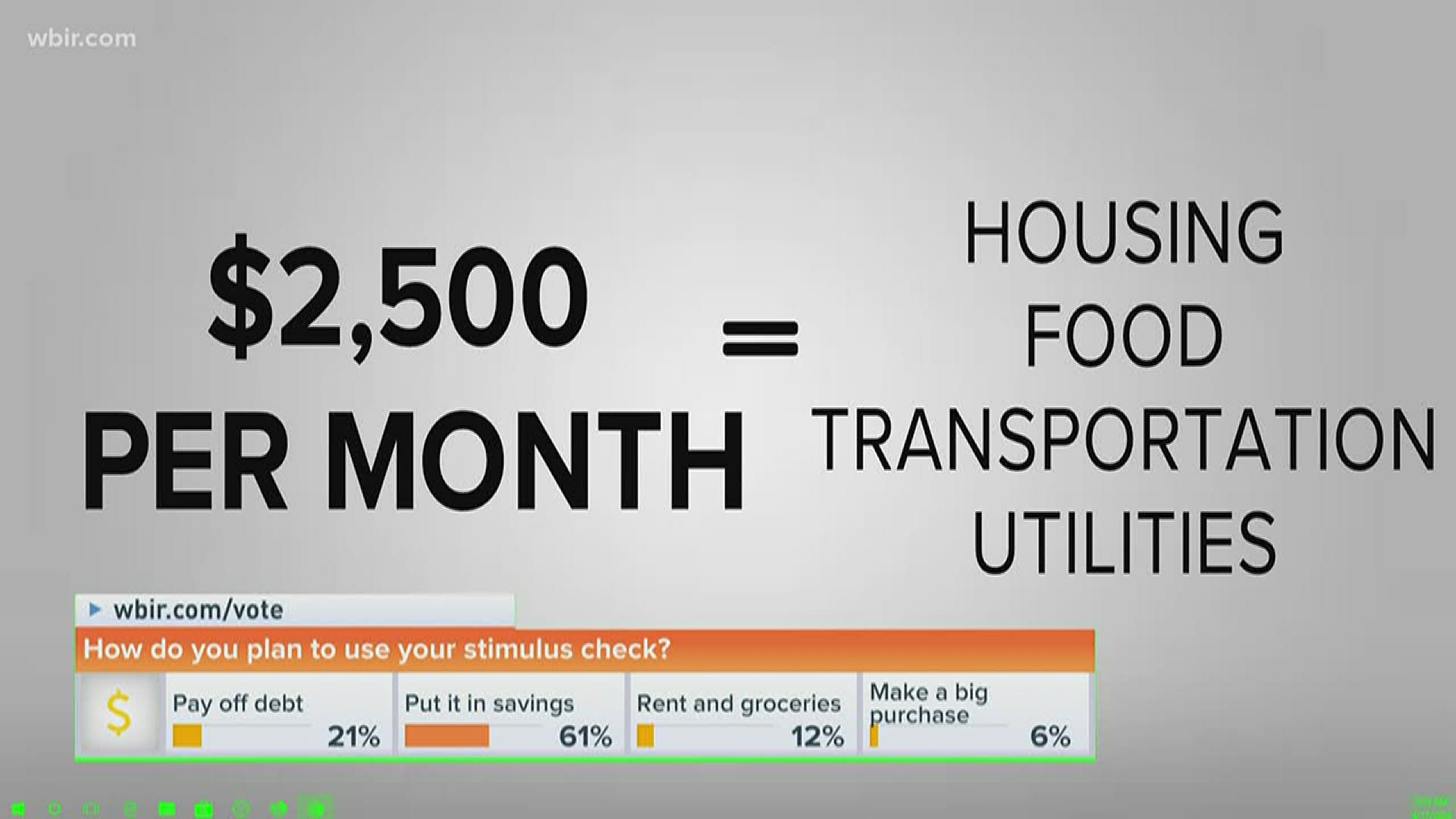

If that person works full-time, he or she makes about $3,472 per month. That's about $41,664 per year before taxes. In one month, according to the Bureau of Labor and Statistics Consumer Expenditure Survey, this person spends about:

$1,256 dollars on housing

$434 dollars on food

$301 dollars on utilities

$166 dollars on gas

$313 on health care

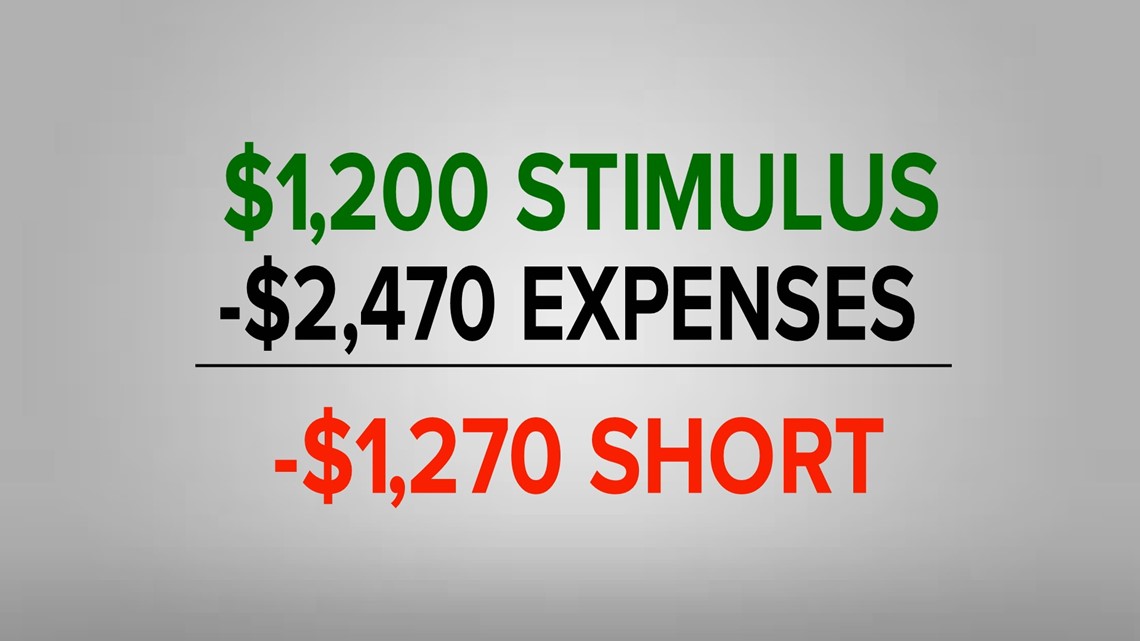

That brings the total expenses for the month to $2,470.

Let's say this person will receive the stimulus check for $1,200 dollars. On this budget, you could buy about two months worth of food, or pay three months of utilities expenses, or about three months of medication.

But here's the bottom line. If you tried to use that check toward all your bills for just one month, you're still $1,270 short. The stimulus checks issued by the IRS should help, but it's not enough to sustain most families long term.

However, there are other resources and strategies that can help. According to Certified Financial Planner Jeff Foster, if you haven't already, start contacting your lenders.

"Most if not all lenders such as, banks or credit unions, are providing some reprieve in this environment. You can contact that institution and ask them for some help," said Foster.

The next step is to prioritize what bills you should pay first. Also, avoid making any frivolous purchases on things that can wait. For those who are able to work and still receive the stimulus payment Foster's advice to you is: save, spend, invest and donate.