The Tennessee Department of Revenue and Airbnb have reached an agreement that will allow the online-based hospitality company to collect and remit sales taxes on behalf of everyone in the Volunteer State who rents out their properties through Airbnb.

Currently, the state's 7,700 registered Airbnb hosts — around half whom are in Nashville — file both their state and local sales taxes individually.

But following the deal with Gov. Bill Haslam's administration, announced by the company Wednesday, Airbnb will soon automatically deliver the sales tax revenue in bulk to the state when it is due.

The new process, which goes into effect March 1, will apply to collections from the 7 percent state sales tax and local option, which ranges from 1.5 percent to 2.75 percent depending on the local municipality.

Guests who use Airbnb will see a new line-item for the sales taxes when booking in Tennessee beginning in March.

New process called more 'seamless and easy' by Airbnb

Tennessee's Airbnb hosts were notified of the agreement Wednesday in an email from the company.

A spokeswoman for the Department of Revenue declined to comment, saying state law prohibits the department from discussing information about individual taxpayers.

For Tennesseans who rent out their homes via Airbnb, the agreement is considered a potential moneymaker because they will no longer need to build the tax rates into the price they charge.

Airbnb is billing the new arrangement as a step toward making the tax process "seamless and easy" for both Airbnb hosts and the state and as a way to generate more tax revenue.

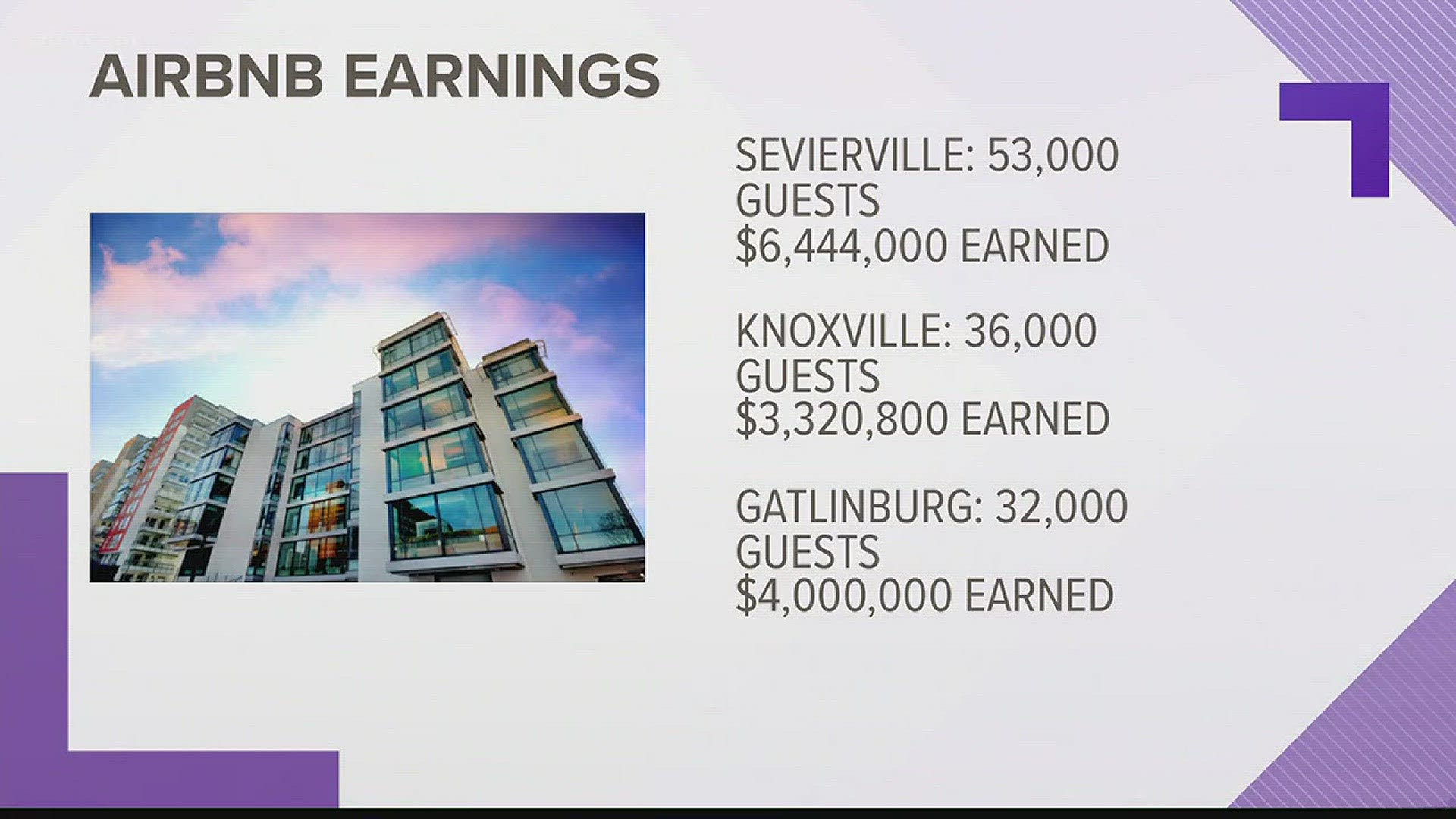

More than $13 million in state and local tax revenue from Airbnb bookings over the last 12 month was due in Tennessee, according to the company. But not all of it was likely paid. The company claims the new agreement will ensure all revenue is collected.

“Home sharing and short-term rentals are introducing a whole new world of travelers to the authenticity of Tennessee while offering new economic opportunities for thousands of middle class residents,” Laura Spanjian, Tennessee policy director for Airbnb, said in a statement. “We applaud the Haslam administration for its business-friendly approach to public policy.”

Change comes as policy fight ramps up in Nashville

The change comes as Airbnb is in a contentious fight in Nashville, where the Metro Council is considering new regulations, including the possibility of phasing out — and eventually banning — short-term rentals in residential neighborhoods that aren't occupied by their owners. The council is set to take up a handful of competing bills on the issue Tuesday.

Over the past year, Airbnb has increased its lobbying presence at the state level — a testament to the company's budding market in Nashville, in particular.

Tennessee Sen. John Stevens, R-Huntingdon, in a statement provided by the company, said he commends the state Department of Revenue for backing Tennessee families who are "maximizing their participation in the sharing economy."

Stevens, an Airbnb ally, is the sponsor of legislation that would overturn Nashville if it passes any type of short-term rental ban. The measure passed in the House but stalled in the Senate last year. The bill is still alive and is hanging over Nashville's local debate as a potential threat.

Airbnb says it has similar tax agreements with around 350 other state and local governments across the country.

But the Tennessee agreement does not apply to hotel/motel room occupancy taxes that are assessed separately from sales tax by local governments. That means most hosts in Tennessee, including in Nashville, will continue to pay hotel/motel taxes to Metro on their own.

“The Metro Department of Finance wants to be clear — this new ruling from the state Department of Revenue only applies to state sales tax and local sales tax for short term rentals operating on the AirBnB platform," Metro Finance Director Talia Lomax O'dneal said.

"Nothing has changed with regard to other platforms or, more importantly, nothing regarding the hotel/motel tax paid by short term rental operators on any platform," she said. "That fee is paid directly to Metro and should continue to be remitted directly to Metro by individual short term rental property owners.”

The lone exception is Memphis, where Airbnb in May announced a local deal that authorized Airbnb to collect and remit its occupancy and tourist taxes. The company says it is "engaged in productive conversations" with both Hamilton County, which includes Chattanooga, and Knoxville regarding similar agreements there.

The company is not having the same talks in Nashville.

Airbnb and other home-renting companies such as HomeAway and VRBO have rapidly become popular alternatives to hotels in Tennessee, particularly in Nashville, which has seen its tourism sector soar. Nashville is the No. 1 market for Airbnb in Tennessee, followed by Memphis.

The company's growth has come with controversy as some residents push back at a short-term rental industry they say has turned homes into party hotels and displaced longtime residents.

Reach Joey Garrison at 615-259-8236, jgarrison@tennessean.com on Twitter @joeygarrison