Many viewers have shared with us that floodwaters got into their homes but odds are you may not be covered.

Home insurance usually doesn't cover flood damage and FEMA says just over a thousand people have flood insurance in Knox County.

So how do know if you're covered, and when does it become worth it? We talked with State Farm agent Jared Hall.

A lot of owners may not get insurance help with cleaning up the mess from this flooding. Home insurance doesn't cover it all so when do people need to seek out coverage?

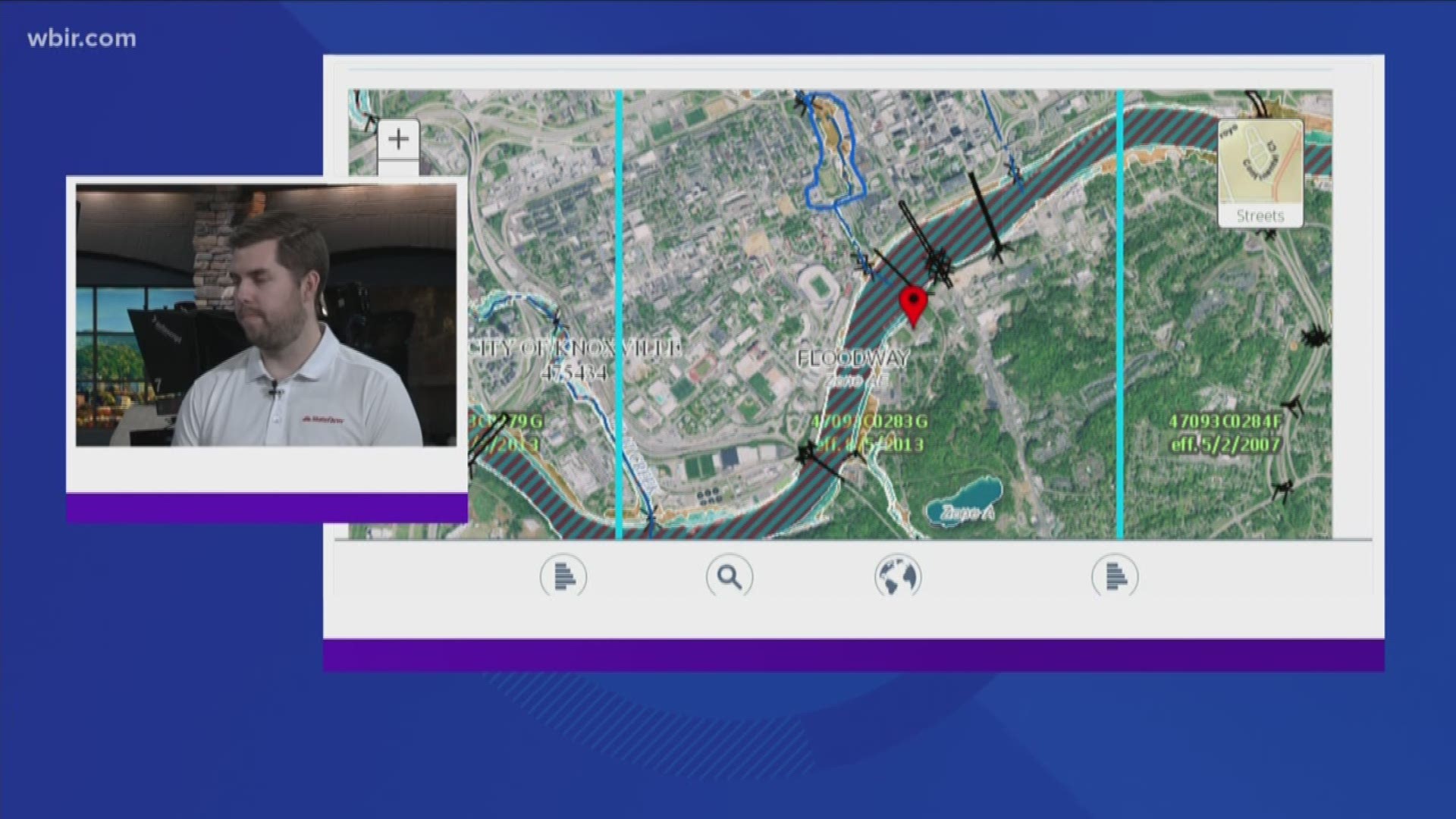

If you live in a flood plain, you should have flood insurance.

Unfortunately, if you didn't get it before the flood you're likely out of luck. You need to secure the insurance before the rain starts.

Hall suggests talking with your agent and figuring out which level of coverage you need. He said without flood insurance, you can still try to file a claim through your policy and if you're denied coverage, there's sometimes assistance through FEMA but it's very minimal if you even get accepted for that type of plan.

You can also visit FloodSmart.gov.

From there, you can learn more about the national flood insurance program, and whether your community is covered.

Rock slides and landslides aren't typically covered but some companies cover earth damages, according to Hall.