CHATTANOOGA, Tenn. — A Tennessee man will need to pay around $1.5 million in restitution to the Internal Revenue Service after pleading guilty to tax perjury, according to a release from the Department of Justice.

Ross A. Rinkes, 66, pleaded guilty to filing false U.S. Individual Income Tax Returns. Sentencing was set for March 7, 2024, and he faces up to three years in federal prison, as well as an additional fine of up to $100,000.

Rinkes is the owner of Rinkes Angus Ranch, a farm near Dechard, Tennessee. The farm bought and resold chicken litter used as fertilizer. It also sold crops to companies that distribute agricultural products.

The release said Rinkes gave false information to his tax preparer in 2015, 2017, 2018, 2019, and 2020. By giving false information to the preparer, his income was underreported each year, according to the DOJ release.

It specifically said on his 2017 tax return, Rinkes underreported his income by at least $520,000 and as a result underpaid his income tax by at least $181,000. The fake income tax returns in the other years resulted in him underpaying by a total of around $679,000, according to the release. As part of the plea agreement, the restitution amount includes unpaid taxes as well as penalties and interest.

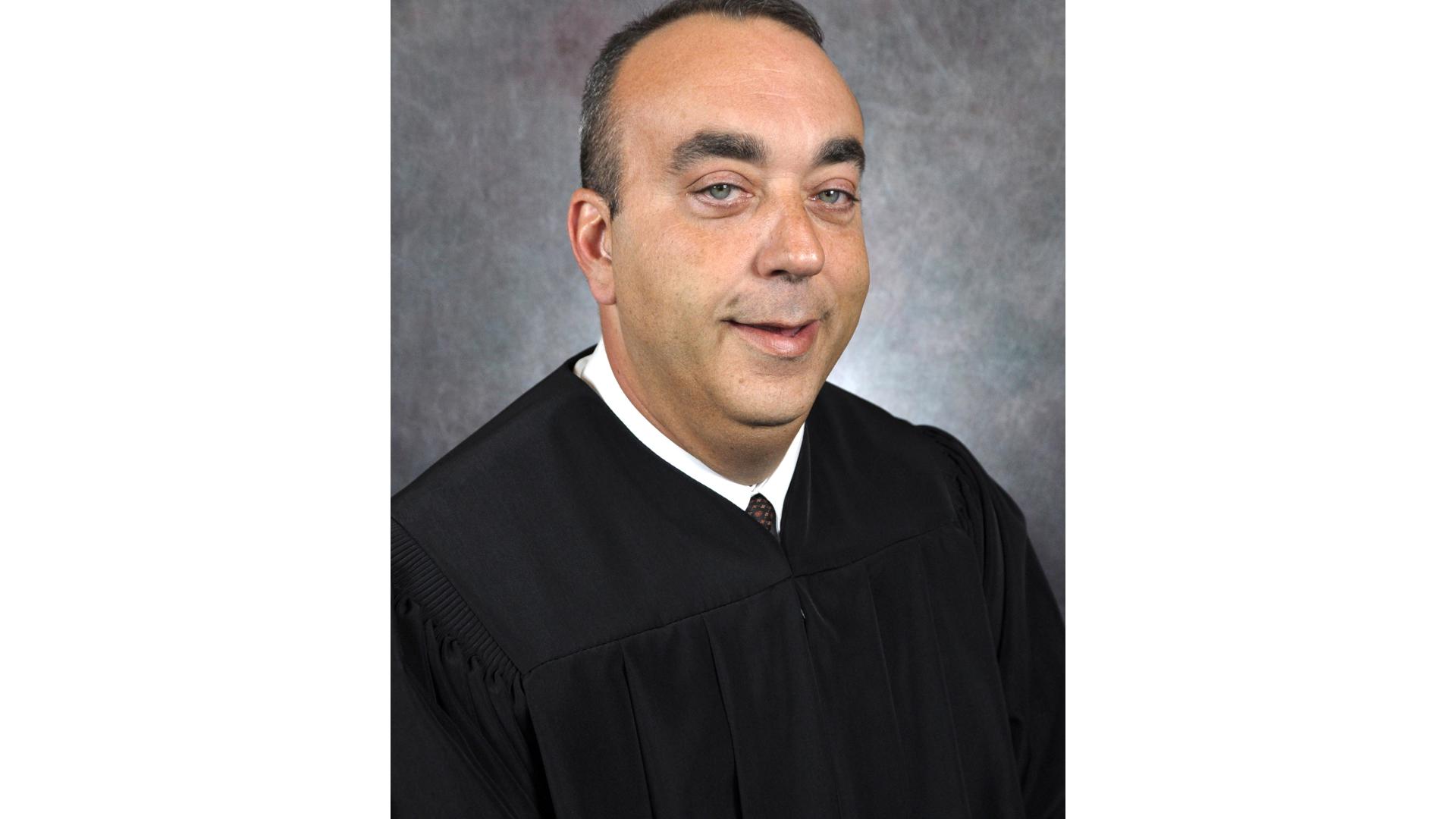

He faces sentencing before Judge Charles E. Atchley in Chattanooga.