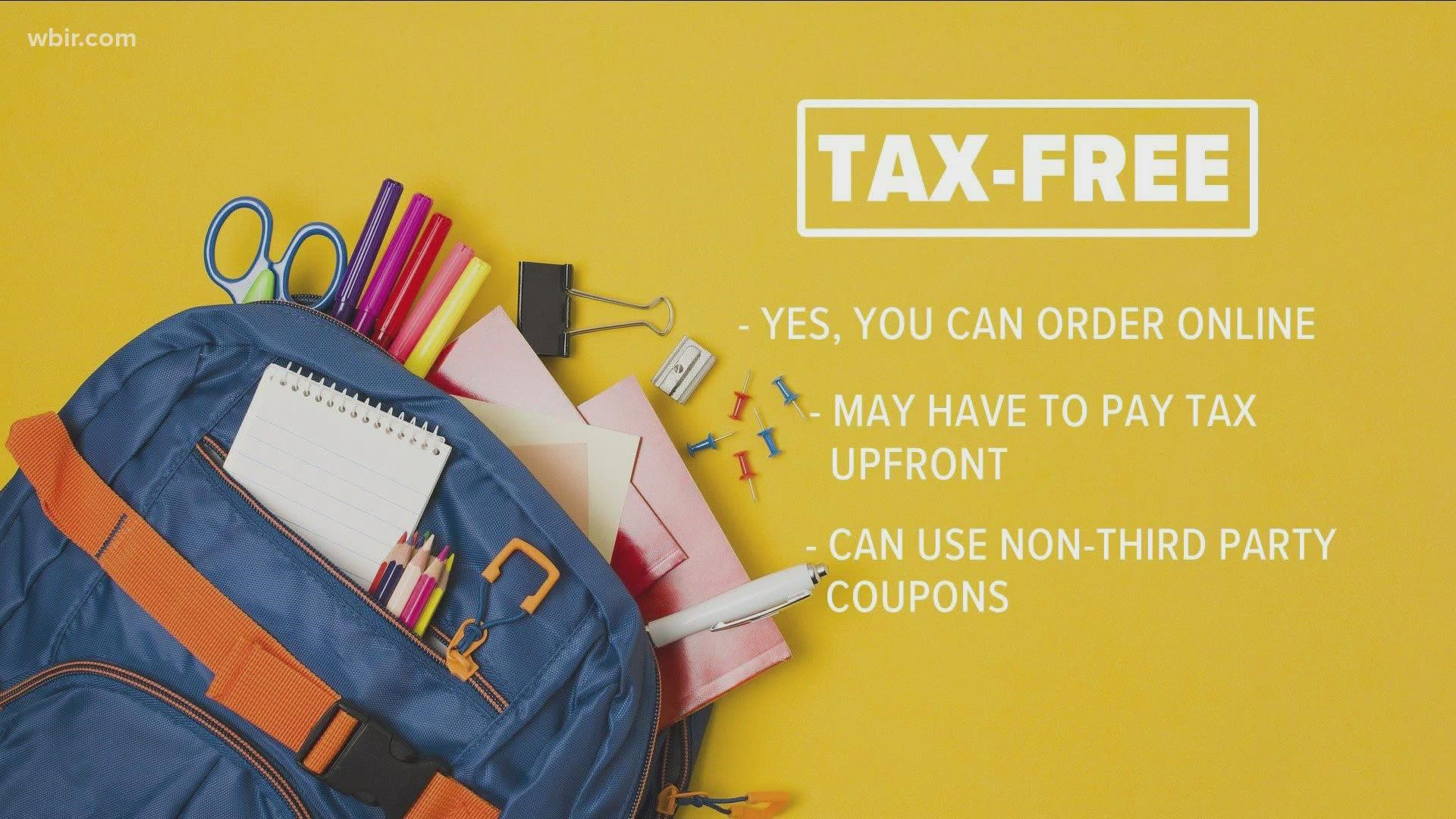

TENNESSEE, USA — Tennessee's annual sales tax holiday for back-to-school shopping is set for July 30-August 1.

For one weekend, you don't have to pay sales tax on items to help get your kids back to school, though anyone can take advantage of the savings.

Here's what's eligible:

- Clothing priced up to $100. It does not include jewelry, purses, or sports equipment.

- School and art supplies priced up to $100 each

- Computers, laptops or tablets that cost less than $1,500. It does not include flash drives, software, printer supplies and household appliances.

That same weekend Tennessee will also launch a week-long sales tax holiday on food, both at grocery stores and at restaurants.

This sales tax holiday also begins on Friday, July 30, but it runs for a whole week, through Thursday, August 5.

Food and ingredients you buy at the grocery store will be tax-free, basically almost anything a person can eat. It does not include alcohol, tobacco, candy, or dietary supplements.

Spanish Version: Tennessee celebrará días libres de impuestos en ventas de artículos escolares, comida y equipos de seguridad para armas

It also includes most things you can buy from restaurants, food trucks, caterers, or grocery stores.

Here's how the state defines what qualifies:

- Is sold in a heated state or heated by the seller,

- Contains two or more food ingredients mixed together by the seller for sale as a single item; or

- Is sold with eating utensils, such as plates, knives, forks, spoons, glasses, cups, napkins, or straws provided by the vendor.

Prepared food does not include food that is only cut, repackaged, or pasteurized by the seller, and eggs, fish, meat, poultry, and foods containing these raw animal foods requiring cooking by the consumer as recommended by the Food and Drug Administration to prevent foodborne illnesses.

A year-long sales tax holiday on gun safety equipment, including gun safes and locking devices, is also underway.