NASHVILLE, Tenn. — The Tennessee Department of Finance and Administration released the state's revenues for August on Wednesday. August marked the first month of the 2024-2025 fiscal year.

“August revenues performed as expected and were in line with forecasted estimate for the month,” said Jim Bryson, Tennessee’s Department of Finance and Administration Commissioner in a release.

For overall revenues, the state brought in around $1.548 billion — around $1.3 million more than the state estimated. However, general fund revenues were around $6.5 million less than projected estimates.

"We are cautiously optimistic at the start of the new fiscal year, and we will continue to carefully monitor economic activity and consumer demand to ensure we meet our monthly budget estimates," said Bryson in a release.

Individual tax revenues saw increases in three of the four major categories against budget estimates and last year's revenues.

Tax revenues against the monthly budget estimates are available below.

- Sales Taxes: $3.3 million above budget estimate (+0.27%)

- Corporate Taxes: $19.3 million below estimate (-32.54%)

- Fuel Taxes: $2.1 million above estimate (+1.95%)

- All other taxes: $15.2 million above estimate (+9.6%)

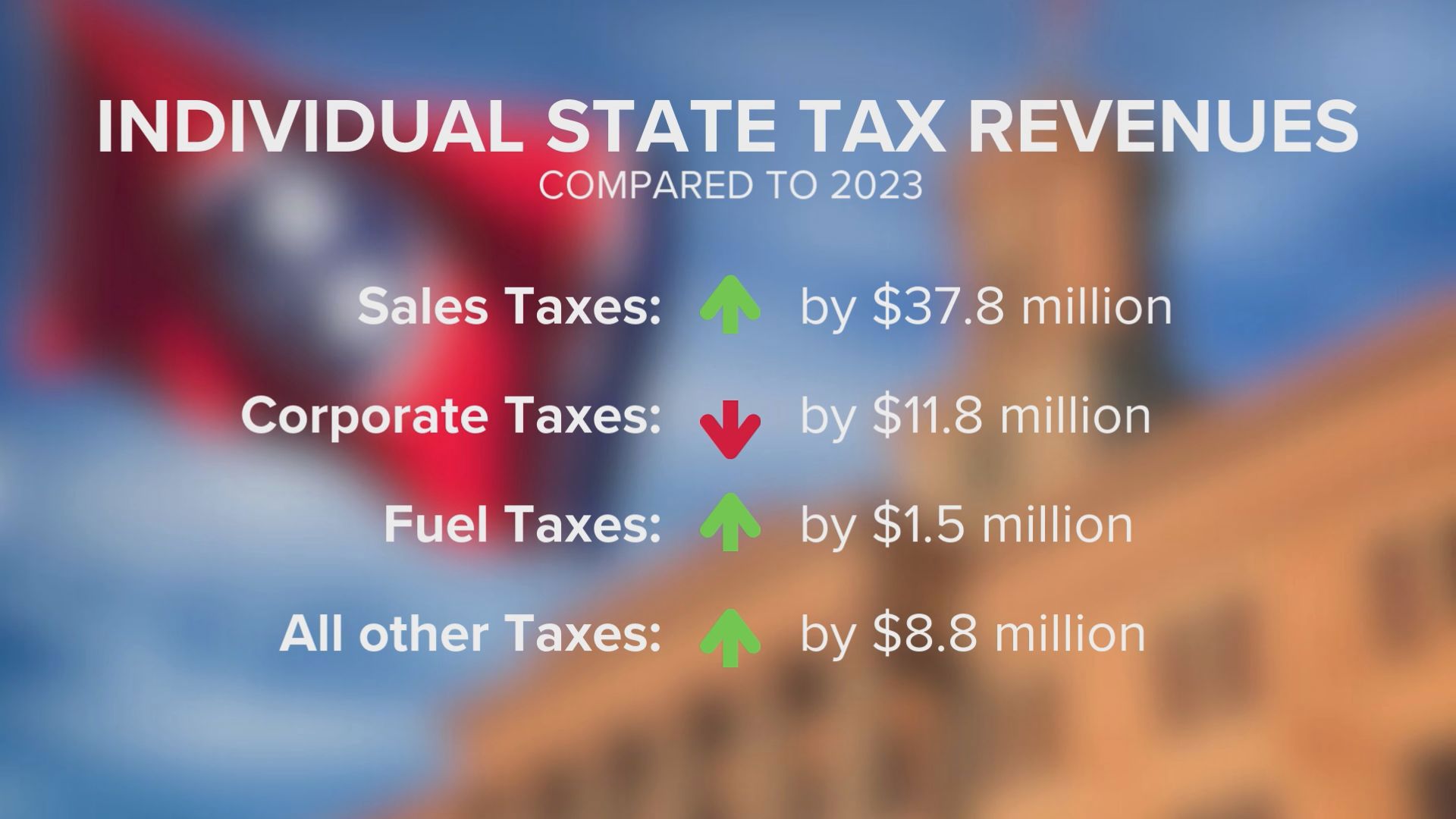

Tax revenues compared to the same time in 2023 are available below.

- Sales Taxes: Up $37.8 million (+3.19%)

- Corporate Taxes: Down $11.8 million (-22.67%)

- Fuel Taxes: Up $1.5 million (+1.38%)

- All other taxes: Up $8.8 million (+5.33%)

Corporate taxes were the only category to underperform against their budgeted estimate for the month of August. Bryson said this is due to recent legislation that reduced the tax liability of franchises across the state.

“Sales tax receipts, reflecting sales tax activity from the month of July, indicates resilient consumer activity while corporate taxes were lower as a result of recent legislation reducing franchise tax liability. All other taxes were greater than the budgeted estimates for the month," said Bryson.

Budget and monthly estimate information can be found on the state's website.