KNOXVILLE, Tenn. — Almost anyone searching for a home is having a rough time in Knoxville's housing market. Prices of homes in the area have reached record-breaking heights, with a historically low number of homes being put up for sale in the city.

The Knoxville Area Association of Realtors released the 2022 State of Housing report on Tuesday. In it, they said that improving economic conditions, low mortgage rates and more migration from outside the area led to historically high demand for all types of housing in Knoxville.

They said home prices appreciated faster than any other time on record and fewer homes were up for sale than ever before.

"As a result, housing costs grew by double-digits from the previous year and have continued to rise through the early months of 2022," they said in the report. "The extent of the current supply-demand gap – and the price growth it has spurred – is truly unprecedented."

They also said the market is unlike the years preceding the Great Recession since the market is not being affected by manipulated demand and loose lending standards. They said home buyers are more qualified than ever, with mortgages going to borrowers with a median credit score of 778 in the fourth quarter of 2021.

They also said most homeowners do not have debt and many own the majority of their house, instead of most of it being owned by a financial institution.

"Under these conditions, the exorbitant home price growth of the past 2 years should be recognized as the result of a substantial supply and demand imbalance – not a temporary or burst-able bubble," the report says.

It goes on to say that East Tennessee is facing a fork in the road: it can produce more homes to continue making them affordable, or it can continue pushing homeownership out of the reach of more people.

They said uncertainty related to the COVID-19 pandemic initially curtailed the supply of homes up for sale in Knoxville. Then, they said the low supply caused an exponentially lower supply, as people held onto homes knowing they may not be able to find another if they sold one.

"A self-reinforcing cycle, fewer existing homeowners are willing to put their homes on the market than in previous years given the limited number of homes for sale and concerns about finding their own next home," the report says.

They said Knox County had 1,332 active listings in 2019. It fell to just 324 listings by the end of 2021, and monthly new listings in the county fell to record lows by the end of the year.

Investors have also gripped the national housing market, restricting the number of homes available for average families looking to buy them. They said many institutional investors found they could make more money by purchasing and renting single-family homes.

"A recent Redfin report found that, nationally, investor entities purchased a record-high 18.4% share of all homes sold in Q4 2021 – up from 12.6% a year ago – with single-family homes representing 3 in 4 investor purchases," the report says. "Of those purchases, 75.3% were paid for with all cash."

However, officials said investor interest in the Knoxville area was at nominal levels. They said investor purchases in Knox County remained relatively low compared to the nationwide average, with investor purchases representing 11% of Knox County home sales in 2021.

However, most of those homes were mid-priced and high-priced homes. Before the pandemic, the report says investors were most interested in low-priced homes. As ar result, investors competed with middle-class homebuyers more often than ever before, according to the report.

They also said Knoxville's economy rebounded after the start of the pandemic, with more jobs available and unemployment rates falling to 2.9% in December 2021. Partially as a result of the economy, housing demand stay historically strong throughout the year.

Yet, they said rises in wages have not covered housing costs in the area. Before the COVID-19 pandemic, they said 83,500 homes in Knoxville spent more than 30% of their income on housing.

"With both home prices and rents growing at some of the fastest rates on record, housing affordability worsened significantly since the pandemic and continued to decline in the early months of 2022," they said. "In a public opinion poll commissioned by the Knoxville Area Association of Realtors in March 2021, more than 1 in 3 registered voters — 34% — indicated housing affordability in the Knoxville area was a big problem, while 28% said the same about housing availability."

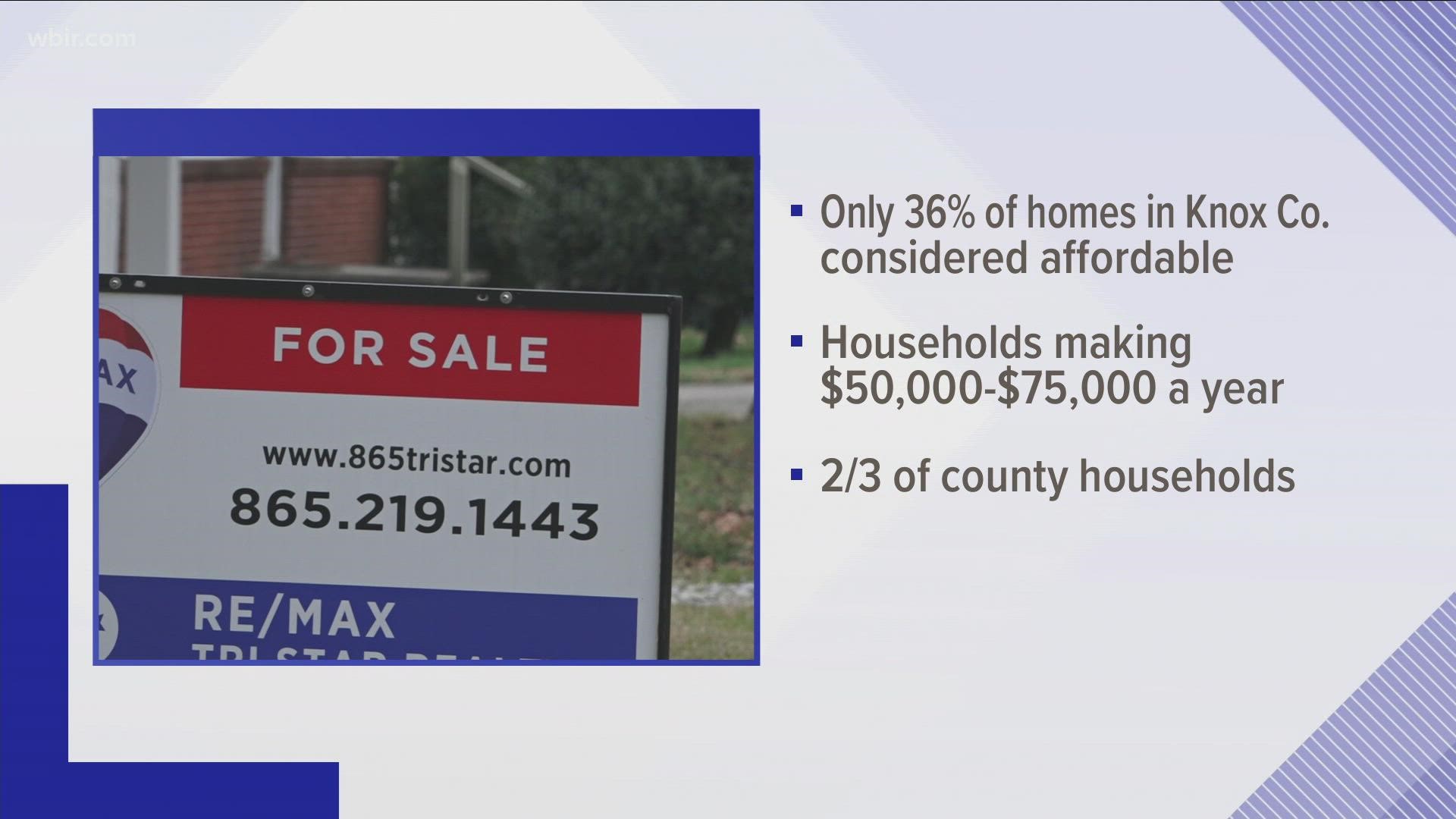

They said a family earning between $50,000 and $75,000 per year could only afford 36% of the active housing inventory in December 2021. It was half that for people earning between $35,000 and $50,000.

They said Knoxville registered more home sales in 2021 than any other year on record. Meanwhile, the median sale price in the Knoxville area increased 19.7% in 2021.

The report says that while owning a home is more affordable than renting in most of East Tennessee, fewer people are getting a chance to own a home.

The report says city leaders should consider finding ways to build more homes in places like Knoxville, where most people are moving to. They also said they could develop a "light-touch density" plan, which would build more single-family homes like duplexes, triplexes and fourplexes.

They also said local government should move away from conventional zoning codes to make sure development decisions are "predictable, fair and cost-effective."

They also recommended building a database to identify vacant and abandoned properties that could be used to build more homes, while also improving regional public transportation to expand areas where people could move to.