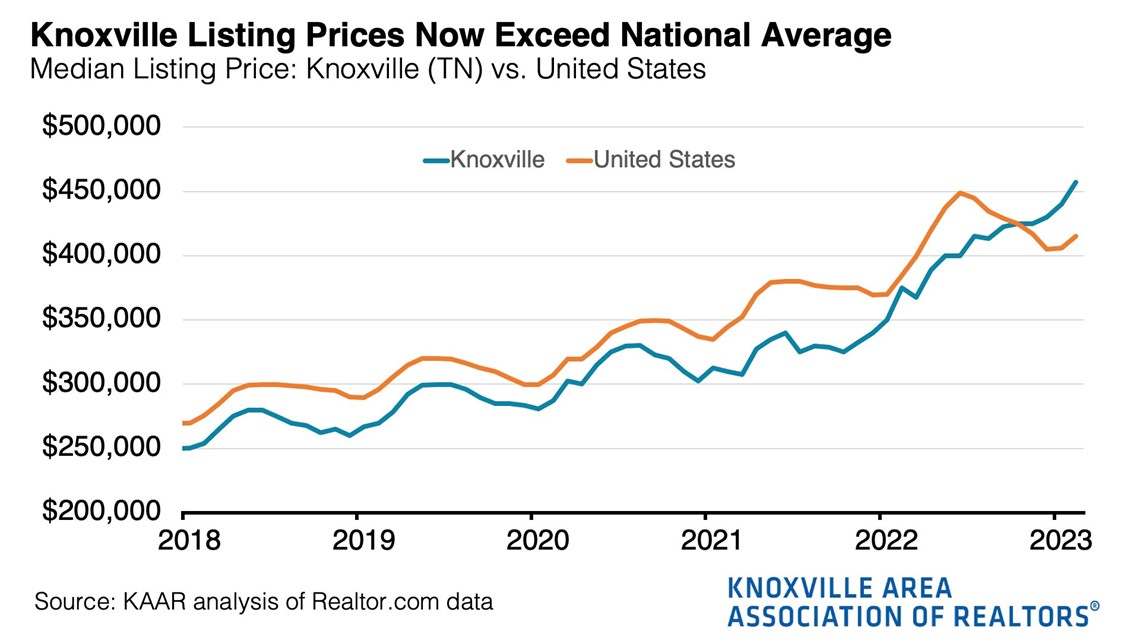

KNOXVILLE, Tenn. — The Government Affairs and Policy Director for the Knoxville Area Association of Realtors said Friday that the median listing price of a home in Knoxville exceeded the national price "for the first time ever."

Hancen Sale posted some data surrounding home prices and showed that the median listing price in the U.S. dropped starting mid-2022 until around the start of 2023. During that time, he said the median price of a Knoxville home rose, passing $450,000, according to an analysis by KAAR of data from realtor.com.

He said that as of February 2023, the city's listing price was around $42,000 higher than the U.S. average.

"If we fail the recognize these trends and invest in our housing supply today, it will be at the expense of future economic growth and development," he said online. "In other words, meeting the rising demand for housing is a challenge we simply cannot afford to overlook."

He also said that by exceeding the national median price of a home, "Knoxville's brand as an 'affordable place to live' and the competitive advantage that comes with it is slowly slipping away."

"We've seen home prices grow really rapidly since the pandemic. It was a trend that we were seeing prior to the pandemic. But really, now that we have started to see a lot more people move here, we've seen the University of Tennessee grow, we've seen a lot of investment on the business side things, and it's really pushed up home prices," he said.

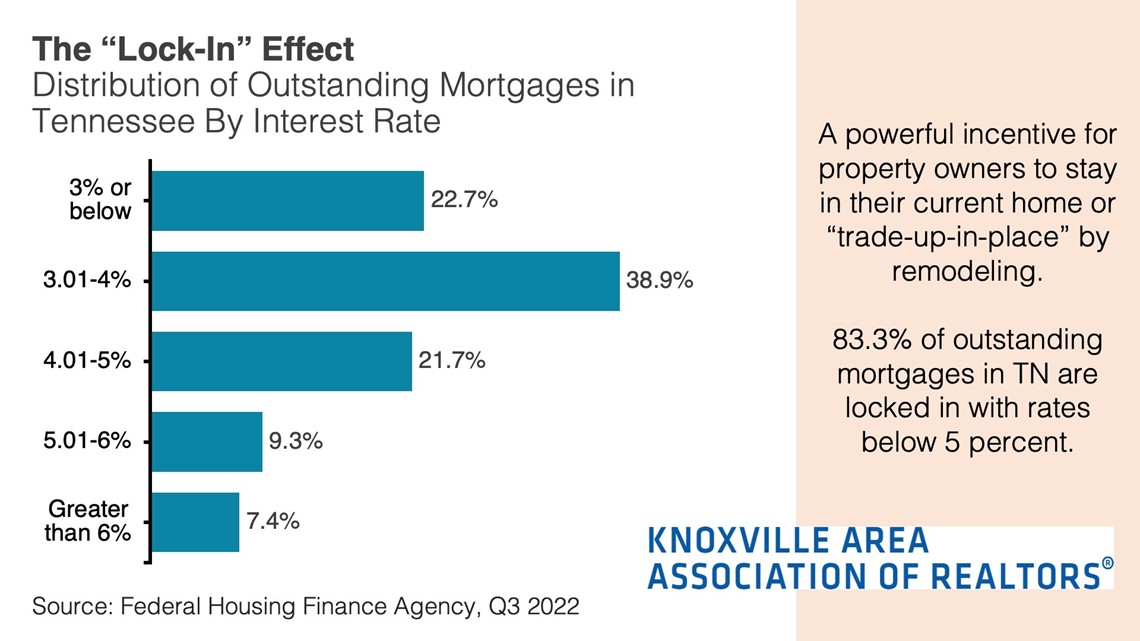

Sale also said that there was not much reason for Knoxville to expect a rise in supply soon, which would bring down the price of a home. He said that as of Q3, the average rate for mortgages in Tennessee was 3.9% — far below prevailing rates.

Homeowners could be incentivized to hold onto their homes instead of selling, since they may not be able to get a lower interest rate on their mortgage. He said this was called the "lock-in" effect and without more people listing their homes, supply would not rise.

He said that 83.3% of mortgages in the state were locked in with rates below 5%, according to data from the Federal Housing Finance Agency for Q3.

"We haven't built to the extent that we need to, and it's reflected in the fact that now our median list price in Knoxville is above the national average, for the first time in our history, which has some pretty major implications for us as a city," he said. "We need to pay attention to these trends because they're going in the wrong direction. If our goal was to stay the affordable place that we've always branded ourselves as."

Sale said that "the only solution is to build more." He also said that as the price of a home rises in Knoxville, the city would have more trouble attracting and keeping young professionals and keeping graduates from UT in the city.

"Housing is the backbone of everything. We can't grow without housing. So we have to think about solutions, and at the end of the day, there is only one solution and that's to build more housing," he said.