KNOX COUNTY, Tenn. — East Tennessee housing affordability waned in 2023, and a real estate group reported fewer homes were affordable for median-income families in the Knoxville area.

According to a report from Redfin, only around 10.7% of homes up for sale in Knoxville during 2023 were in a price range affordable for families making a median income. The previous year, around 22.7% of homes up for sale were considered to be affordable. According to the Census Bureau, the median household income in 2022 for Knox County was around $68,580 per year.

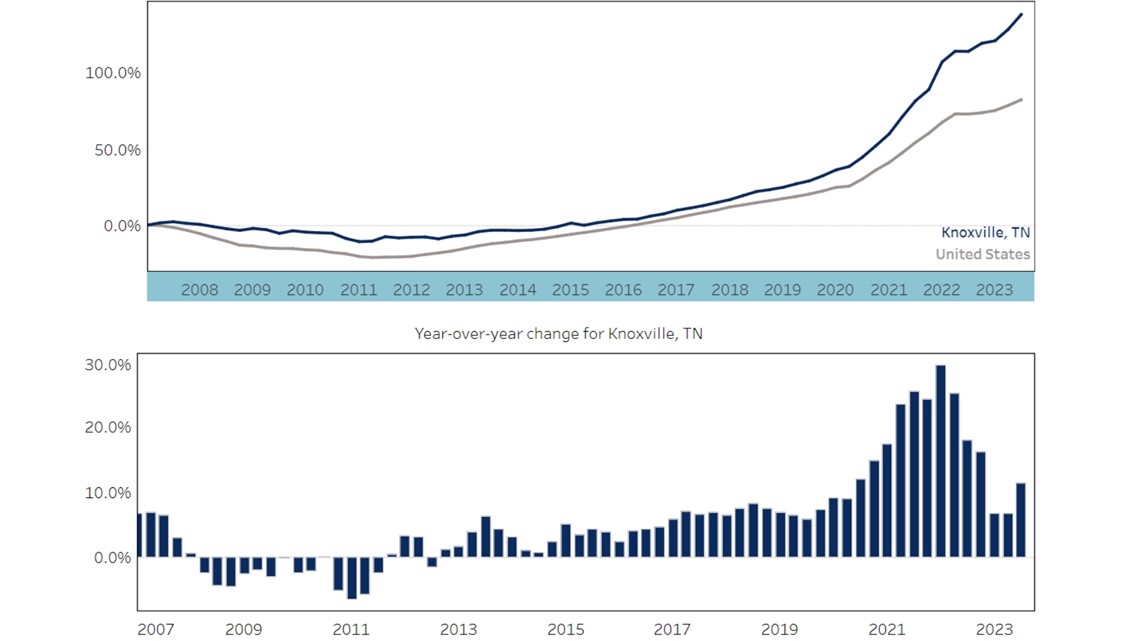

The East Tennessee Realtors group also said the median home sales price in the area rose to $346,000 in November 2023, up by around 10.8% compared to last year. It also said the total number of homes available in the area was up slightly compared to the previous year, an increase of around 3.5%.

Around a quarter of all the homes sold in East Tennessee went for more than the asking price, according to the report. It also said new construction represented around 13.7% of all sales.

"After stalling earlier this year, home price growth across East Tennessee accelerated once again in the third quarter," the report said. "With one month of data still outstanding, home sales across the East Tennessee region are poised to fall approximately 15% in 2023, as higher mortgage rates and home prices have eroded affordability."

It also pointed to federal data showing Knoxville was fourth in the nation for the rate of rising home prices. It said house prices rose around 11.3% over the past year, and rose 4.3% compared to the last quarter. Nationally, home prices rose around 5.5% over the year and rose about 2.1% over the last quarter.

Rochester, NY, ranked third on the list while the Winston-Salem, NC, area ranked second. Prices in the Albany-Schenectady-Troy, NY, area rose the quickest, according to federal data.

The East Tennessee Realtors group said it expected economic conditions to improve and boost home sales in 2024. It noted that mortgage rates fell throughout November, averaging around 6.61% for the week ending Dec. 28.

"With inflation falling at a gradual pace – edging closer to the Federal Reserve's long-run goal of 2% – mortgage rates have plummeted over the past two months and are poised to decline even further in 2024 if inflation continues its current downward trajectory," the report said.

The report also said rent prices continued to rise in December 2023, showing an increase of 3.72% compared to the previous year. Nationally, rent prices rose around 0.16%. It said the average rent for a three-bedroom house in Knoxville was around $2,235 per month in the third quarter of 2023.

The price for a three-bedroom apartment was around $1,799 per month, according to the report.

"Among the five largest cities in Tennessee, Knoxville had the largest year-over-year rent increase for single-family units at 3% in Q3 2023. Nashville, Memphis, and Chattanooga all saw rents decline during the same period," the report said.

The report found rising housing costs have been more pronounced in Knoxville compared to other cities in Tennessee. It said the gap in the price of Nashville homes and Knoxville homes closed by around 6% in the third quarter of 2023. Now, Nashville homes are only around 17% more expensive. It also found that single-family homes are now around 12% cheaper to rent in Chattanooga compared to Knoxville.

"Nearly half of Knoxville voters (48%) reported experiencing some degree of financial strain over housing costs, with even higher levels reported among renters (87%) and those under the age of 50 (61%)," the report said.

Data came from an American Strategies and East Tennessee Realtors poll. It revealed that 48% of voters said housing costs were the most important issue for local government to focus on, with crime and safety ranking second at 20%.

Around 71% also said there was not enough housing for people with moderate incomes, and 80% said there was too little housing for people with low incomes. Around 83% said there wasn't enough housing for younger people and people getting started in their careers.

"Given the region's focus on retaining college graduates and other young professionals, one data point stands out: More than one-third (34%) of voters aged 18-34 reported housing costs were a significant strain on their budget. And while a majority of voters are uneasy about the prospect of looking for a new place to live, younger voters are especially pessimistic: A stunning 95% of respondents aged 18-34 say that they would have difficulty finding a new home in their price range if they had to move today," the report said.

The report also discussed how a growing population of older adults could impact housing across the U.S. It warned that the growing population of seniors paired with rising housing costs is making it hard for older people to find living arrangements that meet their needs. It said around one out of every five East Tennessee residents are 65 years old or older.

The report said more seniors may choose to live alone, which would drive demand for smaller and more affordable homes in communities that include features like no-step entryways or hallways wide enough to accommodate wheelchairs. It also said landlords may start considering modifying multifamily homes to attract and retain senior tenants.

"However, despite the growing need for more accessible and affordable housing options, 70% of the region’s housing stock is comprised of detached single-family homes – which is oftentimes cost-prohibited for seniors living on a fixed income," the report said.