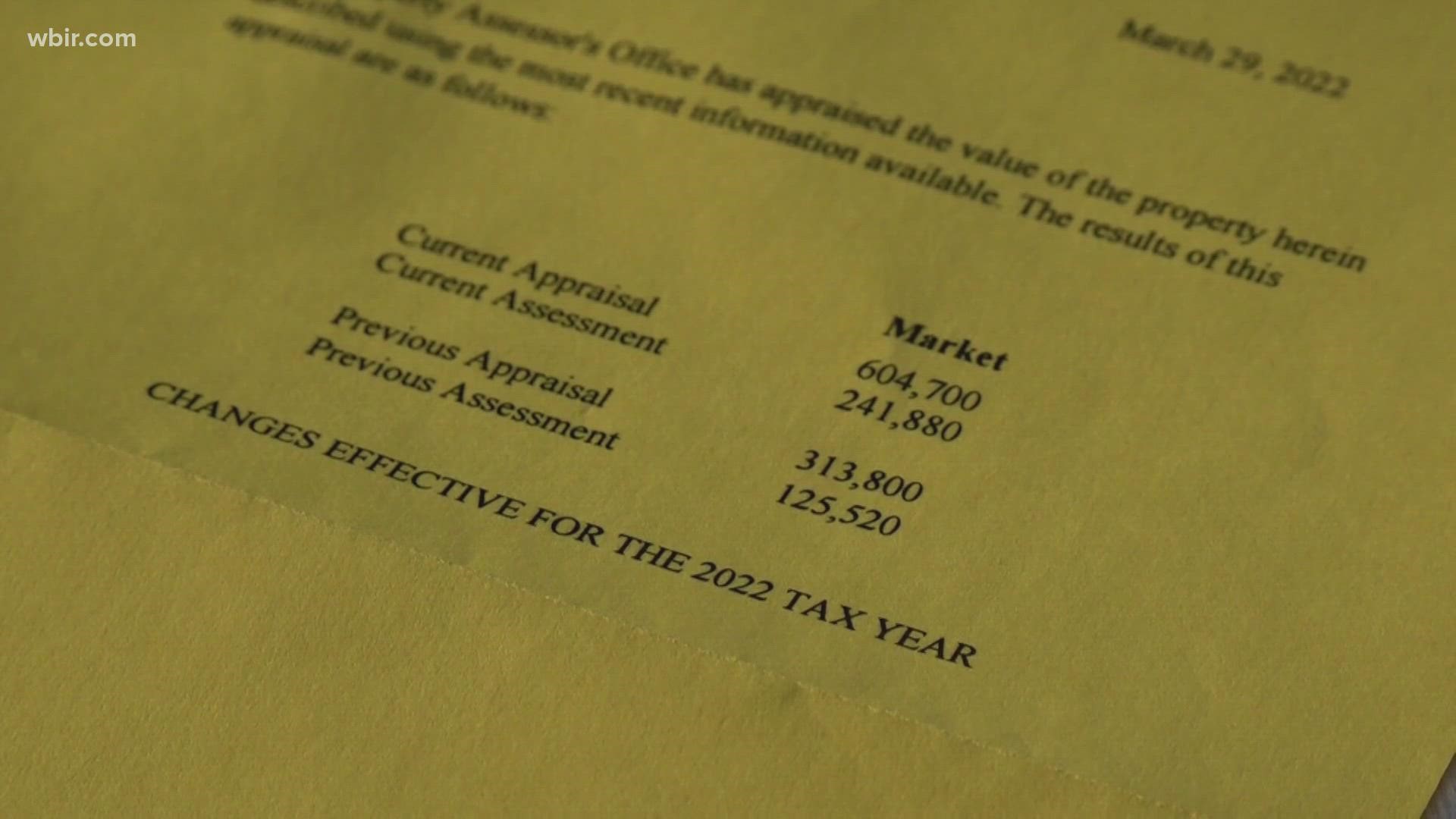

KNOX COUNTY, Tenn. — Property assessments are at the top of homeowners' minds in Knox County right now, and the same is true for businesses.

One thing to keep in mind: Commercial property is assessed differently than residential property. A commercial assessment is calculated at 40%, so business owners will be paying more than homeowners.

John Whitehead, the Knox County tax assessor, said the certified tax rate isn't final until May. He estimated you will pay about 70% of your current property tax value.

"This market has been going on for two and a half years," Whitehead said.

Business owners are going to pay more or less in property taxes depending on your new property assessment.

"The sales in the area, that dictates what the values are," Whitehead said.

We focused on two commercial properties and calculated their estimated property tax increase: one in Market Square and one in Fountain City. In downtown Knoxville, Preservation Pub's property tax is based on an estimated certified tax rate that would go from about $3,884 to $6,003 per year. That's a 54% increase to that downtown spot.

Linda Fisher owns Fisher Tire Co. on North Broadway just outside the Fountain City area. The estimated property tax increase nearly doubled for her shop.

"I was expecting it would go up because it hasn't in several years," Fisher said. "It's shocking that it went up, you know, almost doubled."

Last year, based on the property assessment, she paid about $745 in property tax. This year, based on her new assessment, she will pay about $1,435 per year. That's about $690 more than the years before.

"Everything's going up now," Fisher said.

That's tough on a lot of local businesses already trying to keep up with inflation and shortages.

"Prices have been ridiculous. Everything goes up and we're having trouble," Fisher said.

The Knox County property tax assessor said it's because there's a property shortage.

"We're going to have this market as long as there's a shortage," Whitehead said.

So why is the Fountain City area seeing a comparatively higher tax hike than Market Square? Whitehead said that's because more properties are being sold in the Fountain City area.

"Before, we may of had, you know, a hundred sales in the whole Fountain City area. This time we may have 1,000 sales," Whitehead said.

The tax assessor said he does expect city leaders will push to increase the property tax, which is a move the city hasn't seen in years. They can't legally do so until the certified tax rate is set in May. Knoxville Mayor Indya Kincannon is set to give her budget address on Friday, April 22.