KNOXVILLE, Tenn. — In 2023, Knoxville's home prices were among some of the fastest rising in across the U.S. In 2024, prices are expected to continue climbing — although not as quickly as in previous years.

The East Tennessee REALTORS group released its 2024 Housing Market Forecast on Thursday and said the housing market is expected to rebound after a "prolonged downturn" over the last two years. The group expects home prices to increase moderately, as well as home sales.

The group said an increase in home sales would be partly driven by declining mortgage rates over the next year. While federal leaders recently signaled interest rate cuts were not imminent, the central bank also kept its key rate unchanged at around 5.4%. It could take months for federal leaders to cut that interest rate.

The report also noted that while inflation rates were cooling, they were still above the central bank's 2% target.

"Due to the lagged effects of monetary policy, however, the cumulative impact of the Fed’s rate hikes has yet to be fully realized," the report said.

The East Tennessee REALTORS group said it expects home affordability will improve when mortgage rates decline since more buyers would return to the market and the new rates would make homeowners more confident in selling their homes.

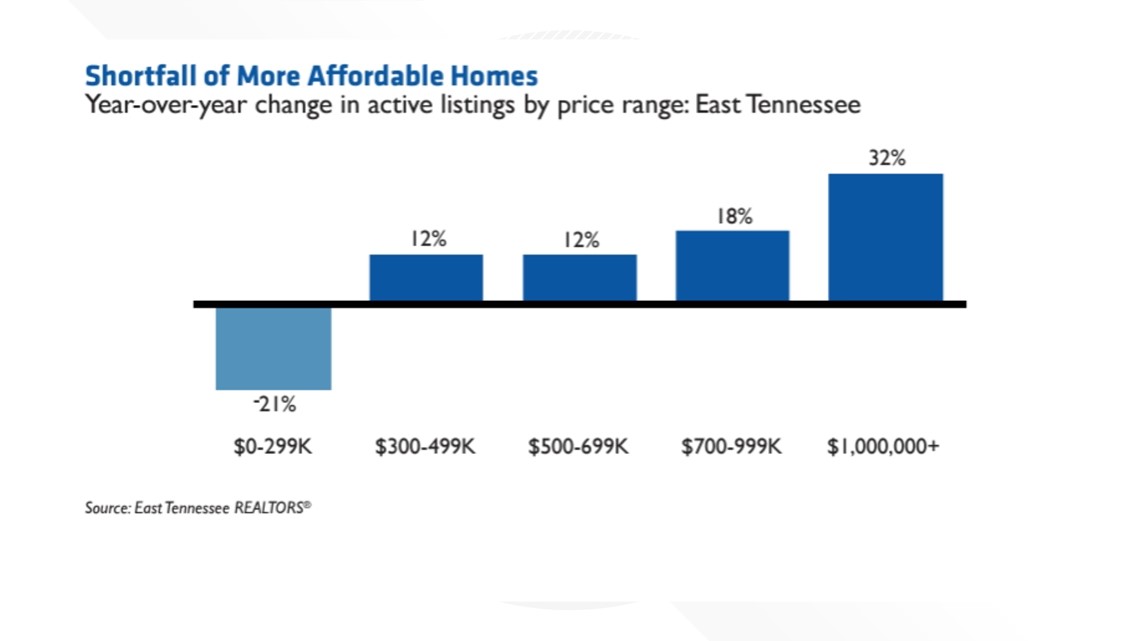

"By comparison, a supply-demand imbalance driven by a chronic undersupply of housing will continue to exert upward pressure on home prices. Other long-term market forces, such as favorable demographic trends, migration and changing household composition, will further stimulate market activity," the report said.

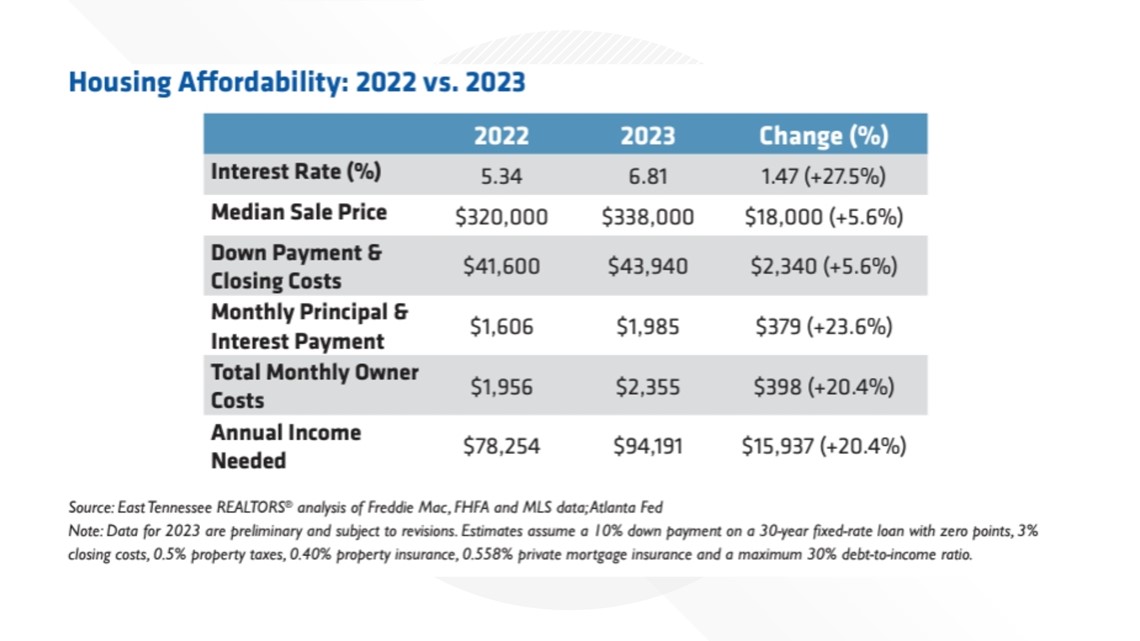

The report said the annual household income needed to afford a median-priced home in East Tennessee went from $78,254 in 2022 to $94,191 in 2023. Around two-thirds of people in the Knoxville area can not afford a median-priced home, according to the report. In 2023, the median sales price of a home was around $338,000 with a monthly mortgage payment of almost $2,000.

"As the effect of higher interest rates continues to ripple throughout the regional economy, there are clear signs of cooling in the labor market," the report said. "Job growth across the region continues to slow, with monthly job gains in November falling below the long-run average for the first time since July 2020. Moreover, the metro’s unemployment rate increased to 3.2% in November."

That unemployment rate is still low by historical standards, the report said. It also said East Tennessee wages grew by around 5% from November 2022 to November 2023, slightly outpacing the national average of 4%.

The report also noted increasing consumer pessimism driven by concerns about the direction of the national economy.

"Consumer confidence in the housing market and broader U.S. economy has plateaued at one of the lowest levels since 2011, according to Fannie Mae’s National Housing Survey. The latest survey data shows that 7 in 10 Americans in December said they think the economy is on the wrong track, with 83% saying they believe it is a bad time to purchase a home," the report said.

Home prices are forecast to increase by around 3.6% in the Knoxville area over 2024, according to the report. Even though home price growth was decelerating, the report said they were still far above the historic average. Home prices rose by around 11.3% compared to the previous year in the third quarter of 2023.

Home sales are also expected to rebound in 2024, returning to pre-pandemic levels. They're expected to increase by around 11.1% by the end of the year, after falling around 9% and 15% year-over-year in 2022 and 2023.

Some of the increased home sales are expected to be driven by "returning buyers," which are people re-entering the market less intimidated by mortgage rates. It would also be driven by a decreasing "lock-in effect," in which homeowners are less incentivized to sell existing homes since they would be faced with higher mortgage payments upon purchasing a new home to live in.

"If the 30-year fixed mortgage rate falls to 6.5% in 2024, approximately 16,734 households in the Knoxville metro area will once again be able to afford the median-priced home," the report said, citing data from the National Association of REALTORS.

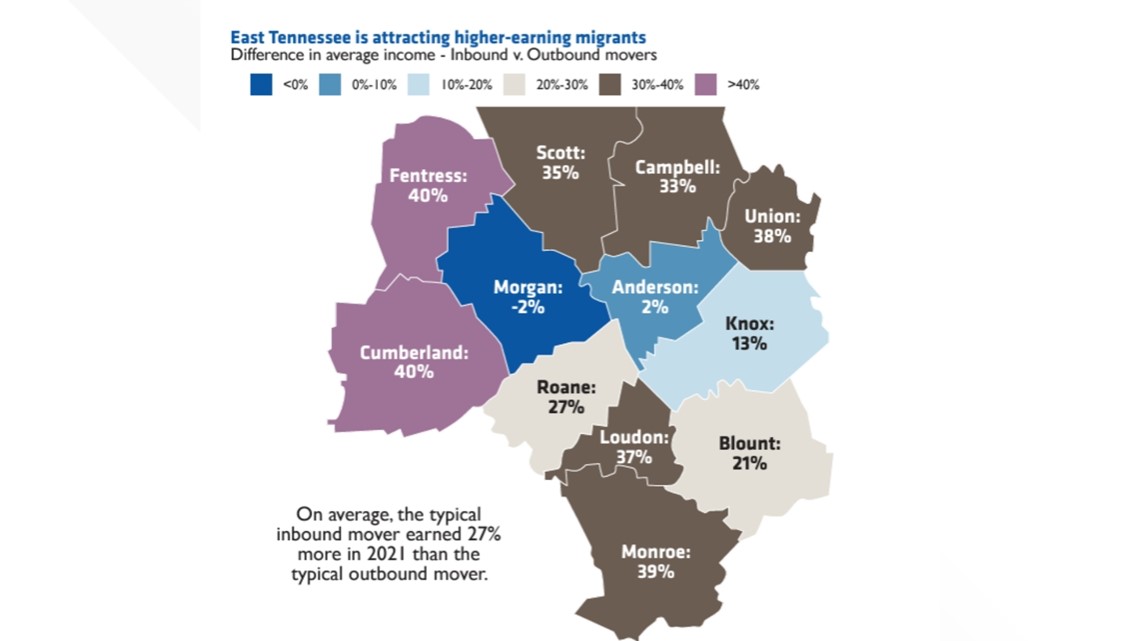

East Tennessee's housing market is also being affected by migration trends, the report said. It said the area's reputation of being low-cost and lacking state income taxes is attracting homebuyers and renters nationally.

The area's rental market is also expected to continue the trend it saw in 2023. The report said occupancy rates in the should drop by around 0.1% to 96.4% — one of the highest in the nation. Effective rent is also expected to rise to around $1,487 per month.

Since 2020, the Knoxville metro area added 3,127 new apartment units, increasing the number available by around 6%. At the end of 2023, there were 2,529 new units being built, with 71% of them set to be completed in the next year.

"Even with the significant growth in rents and occupancy, the past three years have nonetheless marked a period of significant turbulence within the multifamily sector," the report said. "Knoxville’s rental market is expected to experience modest, positive growth in 2024 as a strong labor market, above-average renewal rates and underlying demographic trends will bolster demand in the year ahead."