KNOXVILLE, Tenn. — The East Tennessee REALTORS group released its monthly report on Thursday, noting home prices continued rising compared to the previous year despite decreasing sales and an increased inventory. The report also said mortgage rates are expected to flatten over the coming year, after several months of rising rates.

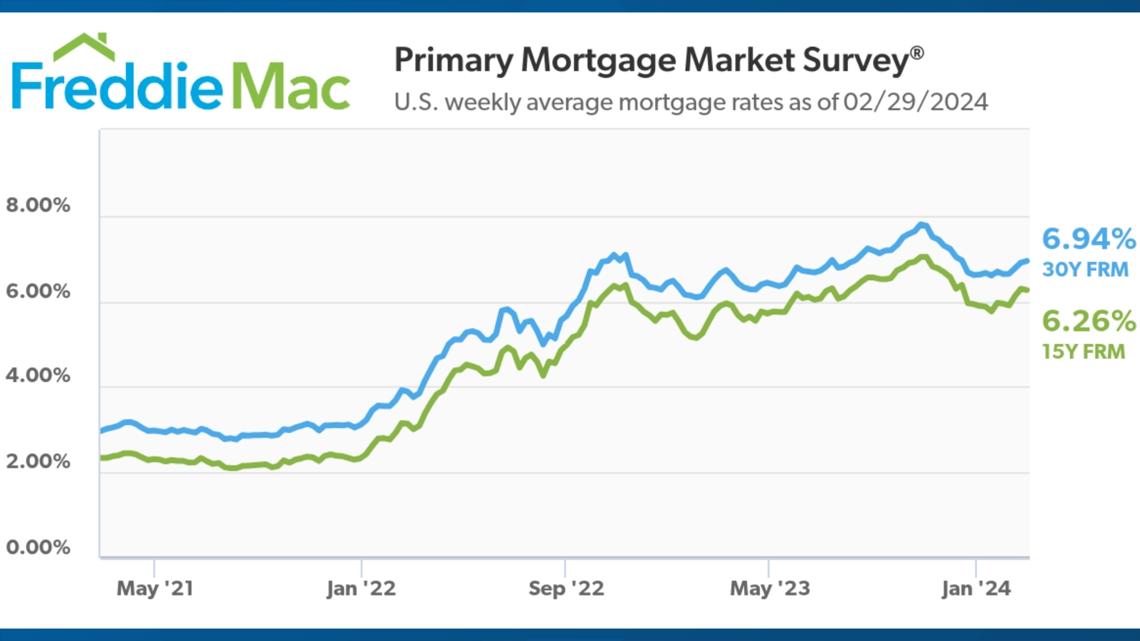

Although the mortgage rates in February continued to rise from 6.5% this time last year to 6.94% now, Freddie Mac data said that the Federal Reserve appears to be ready and willing to hold interest rates at their current level until the middle of the year.

"The risk of waiting a little longer to [cut interest rates] is lower than the risk of acting too soon and possibly halting or reversing the progress we've made on inflation," the report said, quitting from the governor of the Federal Reserve, Christopher Wallen.

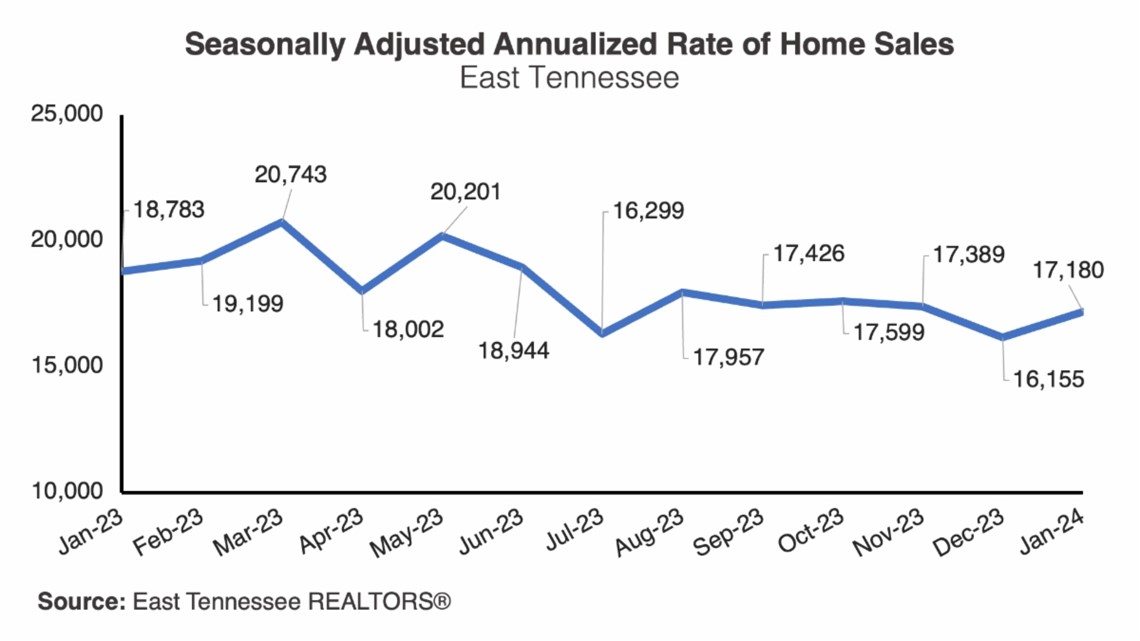

Without rising mortgage rates, home affordability may improve, the report said. It said the total number of home sales decreased by 15.2% from 2022 to 2023, making it one of the largest annual drops ever recorded. However, despite the drop in home sales, the prices grew 5.3% from the previous year.

Apartment rent increases were recorded as slowing in January with rent across the Knoxville metro area only growing 3.7% from last year. The average rental price increase nationally during that time was only 0.25%. The report said that Knoxville's overall growth helped lead to rent price increases. The city is 17th on U-Haul's list of top-growth cities in 2023.

East Tennessee placed eighth in the U.S. for housing price growth, with a rise of 11.7% from the previous year. Despite the rise in overall housing prices, home sales across the region are expected to increase by 3.6% according to East Tennessee REALTORS.

The group said that new construction represented 16% of total home sales in 2023 with the housing inventory up 19.2% from a year ago. The rate of home sales did increase over the last three months, largely credited to that "uptick" in new construction sales.

According to the group, the housing market remains down as of Feb. 29 due to a lack of resale inventory and "prolonged affordability constraints."

"However, inventory levels are set to experience some improvement as we move closer to the spring selling season and affordability conditions are expected to be fairly stable, providing more certainty for buyers and sellers alike," the report said.

According to East Tennessee REALTORS, there are several issues within the housing market. One of these issues is off-street parking. In most U.S. cities, the parking required for a two-bedroom apartment is more than twice the size of each unit. This factor also drives the costs up because parking typically accounts for 17% of the price of an apartment. So as more apartments are built in Knoxville, more parking also needs to be built, according to the report.

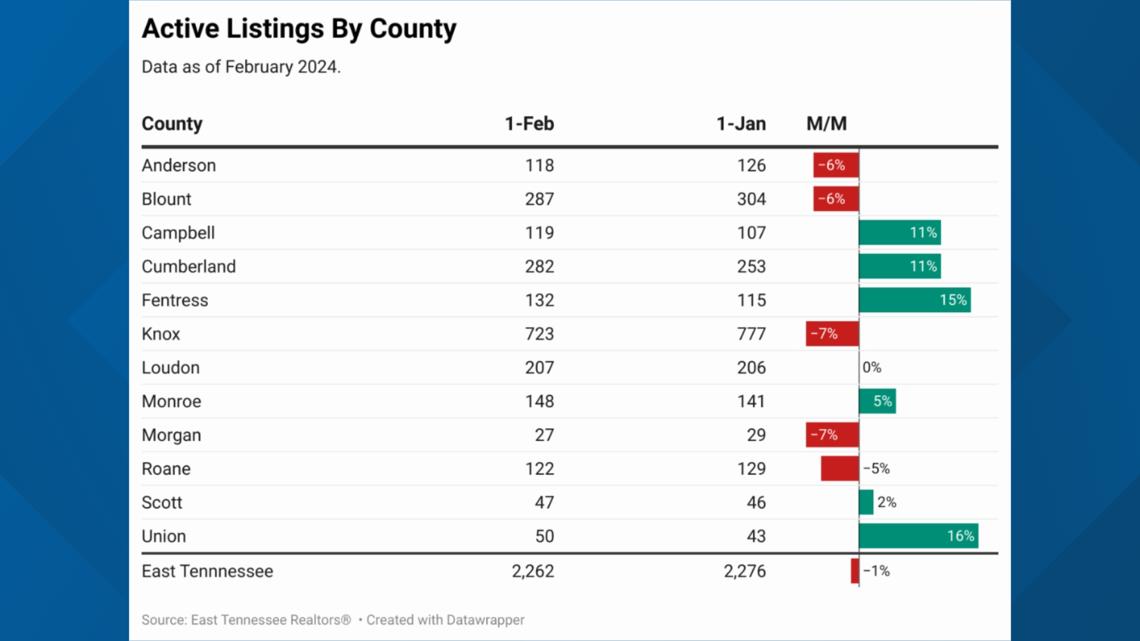

The group said that active listings in the region were down by around 1% in February with Knox County seeing the largest decline of 7% of active listings. In Fentress and Union Counties, the largest increase at 15% and 16%, the report said.

According to East Tennessee REALTORS, Knoxville's middle housing plan is becoming a reality as it was approved in early February. The plan will effectively allow denser housing on smaller lots, which will allow more constructions such as duplexes and townhomes. These buildings will reportedly still meet the aesthetic of their surrounding neighborhoods.

"Effective Feb. 22, the plan introduces a new zoning structure in Traditional Neighborhood Residential zones, which make up about 25% of the city's residential lots," the report said.

The group said that since the COVID-19 pandemic, there has been an influx of newcomers which caused the prices of homes to "grow at one of the fastest paces on record."