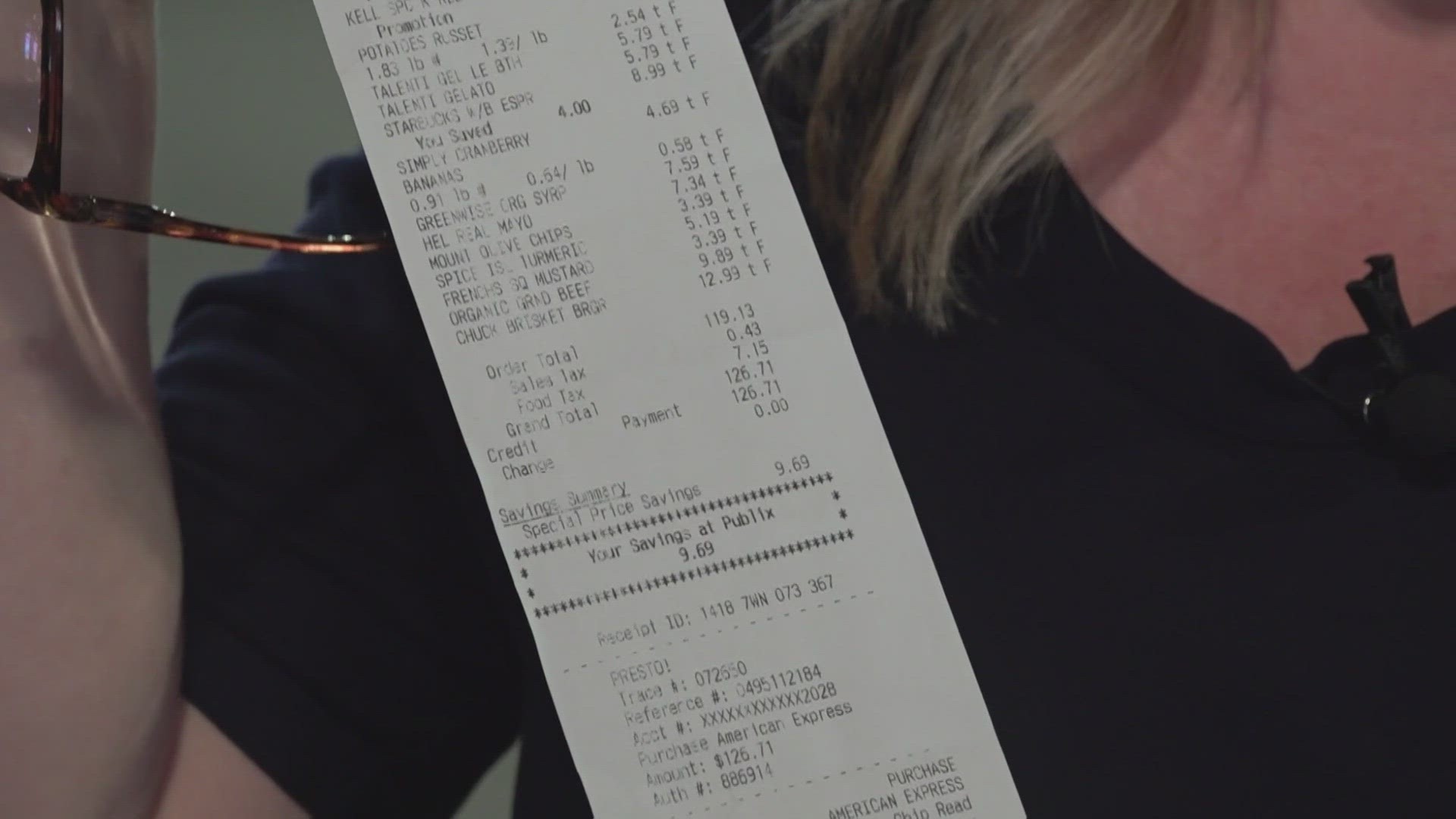

KNOXVILLE, Tenn. — Starting Tuesday, most groceries and food ingredients are exempt from sales tax in Tennessee.

It was a part of the Tennessee Works Tax Act, which the state legislature passed this year. It approved more than $400 million in tax cuts. The USDA also said it expects a rise in the price of staple food items in August, such as a 4.5% increase in the price of meat, 3.3% more in poultry and 3.6% in dairy prices.

State leaders said they estimated people in Tennessee would save a total of $288 million over the next three months by not paying taxes on food.

"This is going to be huge in the long, taxes are high here," said Susan and John Calathes, a couple who went shopping for food.

The Calathes are grandparents to 12 kids and have five boys. They said they are often paying a visit to the grocery store. Like the Calathes family, Milena Keys sees the tax cut as a relief for parents.

"It's going to help with a lot of the costs," Keys said. "A lot of my costs are pretty high. Even though I only have one child, it's like I have five."

Here's what you need to know.

How long is the grocery tax holiday?

The grocery tax holiday begins Tuesday, Aug. 1 at 12:01 a.m. and ends Tuesday, Oct. 31 at 11:59 p.m.

What items are tax-free?

Almost all food and food ingredients are tax-free during the holiday. The Tennessee Department of Revenue defines these items as "liquid, concentrated, solid, frozen, dried, or dehydrated substances that are sold to be ingested or chewed by humans and are consumed for their taste or nutritional value."

What isn't tax-free?

Prepared food, tobacco, alcohol, candy or dietary supplements are not tax-free.

For more information, click here.