The state's insurance commissioner has approved the premiums requested by the three companies lined up to sell insurance on the Obamacare exchange in Tennessee in 2018.

BlueCross BlueShield of Tennessee, Cigna and Oscar Health each received approval from Julie Mix McPeak, commissioner of the Tennessee Department of Commerce and Insurance.

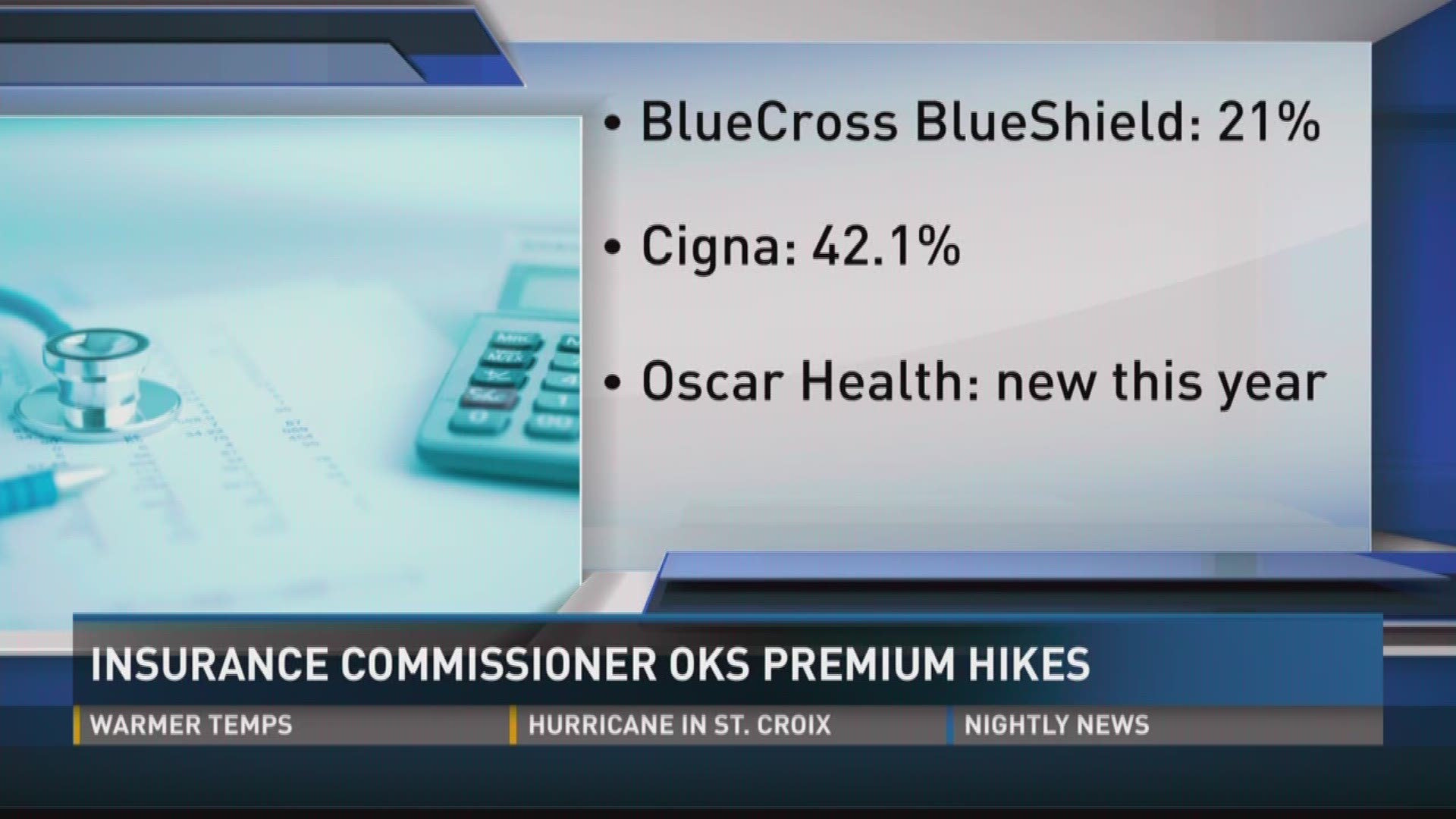

Cigna premiums will increase an average 42.1 percent, while BlueCross BlueShield of Tennessee asked for 21 percent, most of which is attributed to federal uncertainty. Oscar Health is new so there is no prior year comparison. Most Tennesseans, more than 80 percent, who buy inidivdaul insurance receive tax credit that offsets the premium costs.

Uncertainty — wrought by the ongoing debate over Obamacare repeal-and-replace legislation and decisions by the White House and HHS officials — have clouded the premium request process, and led to higher requests.

Cost-sharing reductions, a subsidy that offsets out-of-pocket costs for some shoppers, are divisive in Washington, D.C. There is no long-term commitment that CSRs will be paid to insurers, and the decision is being made monthly.

BCBST attributes nearly all of its average 21 percent premium increase request to the unknowns of the upcoming year.

The latest Affordable Care Act repeal-and-replace bill, Graham-Cassidy, would eliminate the individual and employer mandate, which could potentially throw the 2018 insurance market.

Sen. Lamar Alexander has halted the hunt for a bipartisan fix for the exchange, which McPeak said disappointed her. She and Gov. Bill Haslam testified before Alexander's committee earlier this month.

McPeak said in a statement that "while Tennessee is supportive of long-term strategies such as the Graham-Cassidy Amendment," she appreciates the "diligent efforts of Sens. Lamar Alexander and Patty Murray to find common ground in providing more immediate stabilization in the marketplace."

"Instead, it appears more likely that Tennesseans must prepare themselves for a round of actuarially justified rates for 2018 that are far higher than could be necessary as a result of uncertainty in Washington. On behalf of Tennessee consumers, I continue to urge Congress to take action to stabilize insurance markets. The Department stands ready to take action to aid consumers should stabilization measures be enacted,” McPeak said in a statement.

Open enrollment begins Nov. 1 and runs through Dec. 15 — six weeks shorter than last year.

HHS reduced its national advertising campaign by $90 million, leaving organizations around the state scrambling to find ways to make sure people know about the shortened time period.

The rates and commitment to sell is not final until insurers sign contracts with the U.S. Department of Health and Human Services. The deadline is slated for Sept. 27.

Who is selling where:

- BCBST, most areas except Greater Memphis and Greater Nashville

- Cigna, on exchange in Memphis, Nashville and Tri-Cities

- Oscar Health, a newcomer to the Nashville market

Reach Holly Fletcher at hfletcher@tennessean.com or 615-259-8287 and on Twitter @hollyfletcher.